At the end of 2023, our annual State of the Industry report highlighted that the legal sector experienced heightened turbulence. While the previous two years were marked by reactionary measures aimed at regaining stability, 2023 saw firms responding to significant events by scaling back on corporate attorney hiring due to recession fears rather than proactively pursuing their goals and differentiating themselves. Given the rapid pace of changes occurring at law firms, we decided to revisit several key barometers of industry health at the half-year point of 2024 for the first time in Leopard’s twenty-year history. Our analysis, presented in the charts here illustrates how law firms are faring six months into 2024 and how it compares with last year. As we reach the halfway point of 2024, it’s evident that firms are adopting a more cautious approach to growth, prioritizing efficiency and profitability over rapid expansion.

Diversity in Big Law: What a Difference a Year Makes

A comparison of high-probability ethnically diverse attorney headcounts (partners, counsel, and associates) at Am Law 200 US-based offices between the first half of 2023 and the first half of 2024 (between January 1 and June 30 of 2024) shows things have taken a glum turn. A Supreme Court ruling effectively striking down affirmative action and the malign influence of litigant Edward Blum and the shadowy PACs backing him, which sought to scare firms into abandoning their DEI programs, is giving the intended effect. The number of diverse associates who joined Am Law 200 firms dipped by 1,942, comparing the first two quarters of the past two years, potentially linked to overall declines in minority law school graduates.

Too Soon to Declare a Full-throttle Comeback, the M&A Practice Exhibits Signs of Thawing After Post-Surge Stagnation

If we go back to the onset of 2021, when M&A activity began a meteoric climb emerging from the pandemic-era doldrums, the specialty has seen 15% growth. While the trajectory has seen peaks and valleys since hitting a crescendo in 2022, mid-year data indicates deal flow is picking back up. The number of M&A attorneys joining Am Law 200 firms since this time last year has increased by six percent, while lateral hires have also modestly ticked upward by two percent. It will be interesting to see if these gains carry over into the third and fourth quarters.

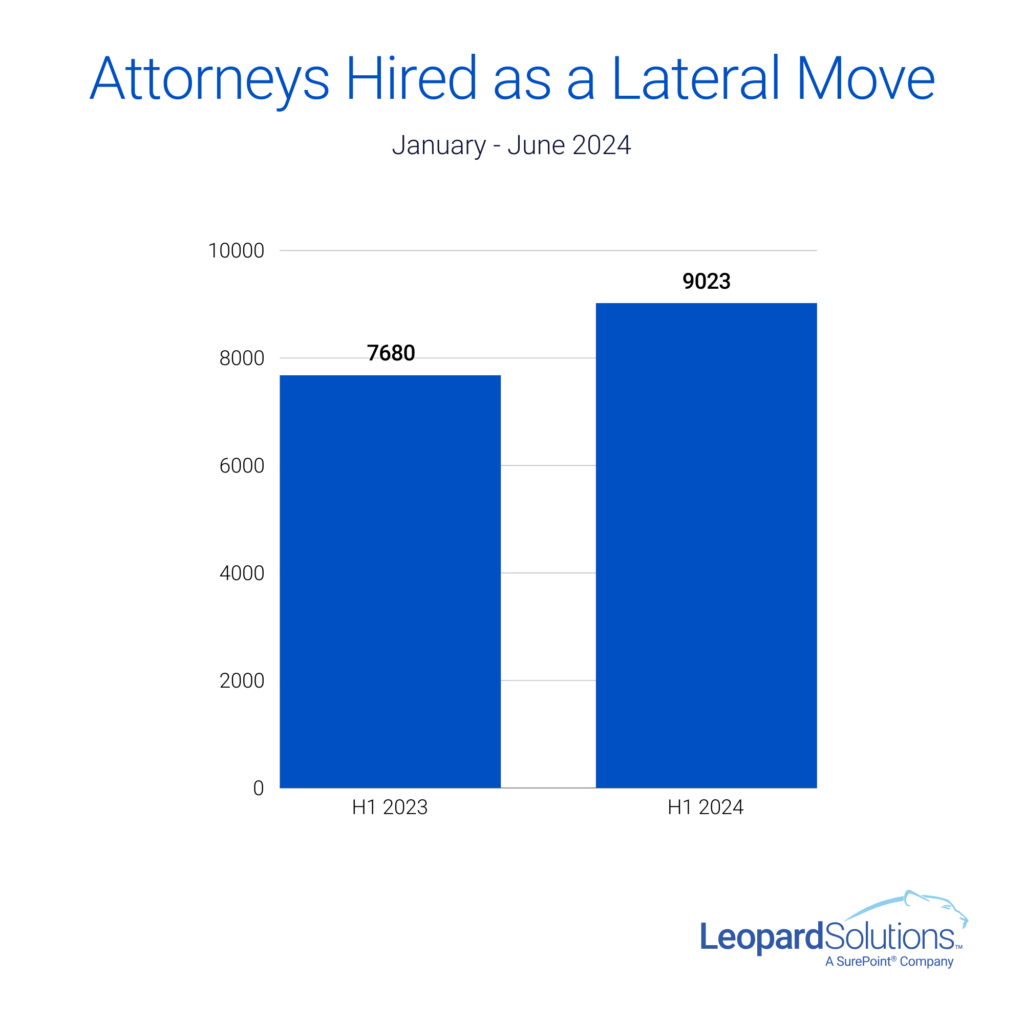

Lateral Hiring is the Catalyst Behind Overall Firm Year-on-Year Headcount Expansion

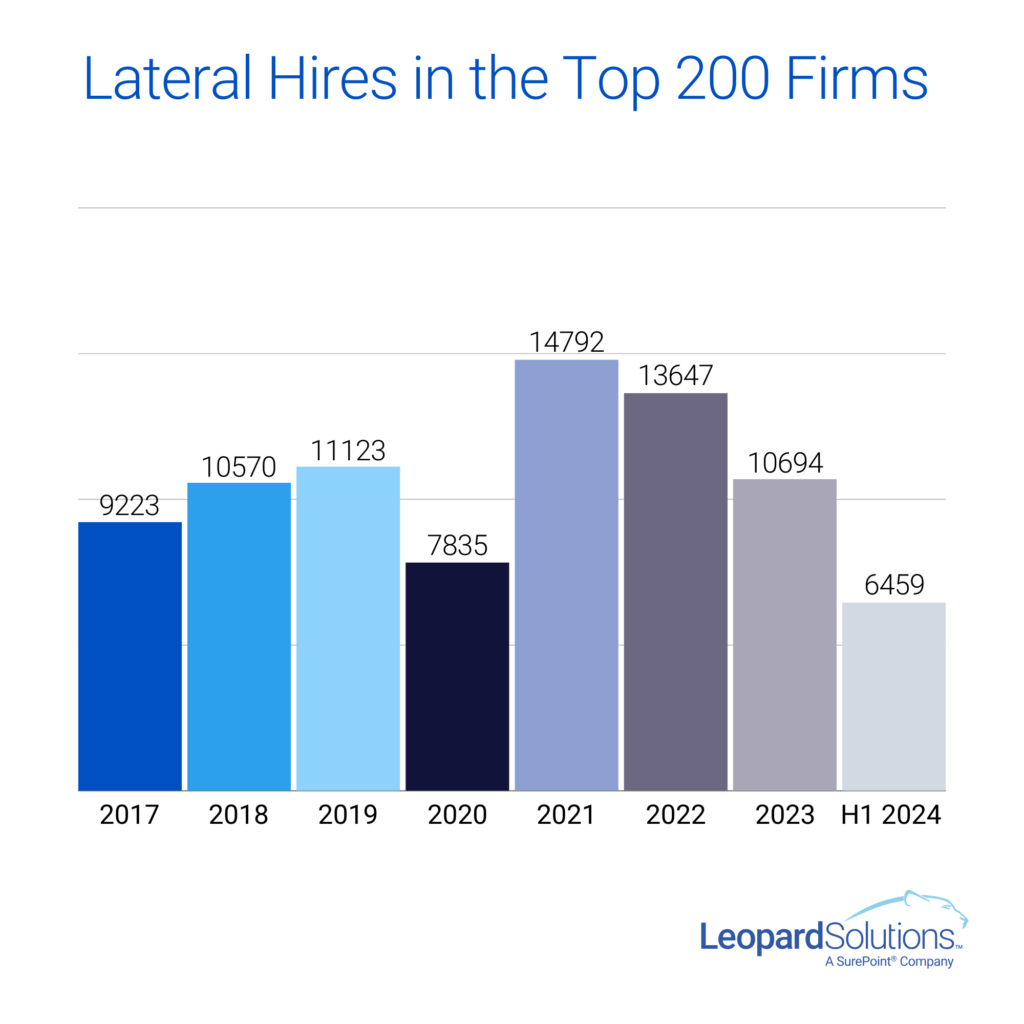

Half-year lateral activity at Am Law firms has seen double-digit growth (17%) compared to the first six months of 2023. This represents a tactical shift from 2023, when new hires seemed to be in the direction firms were heading. That has decidedly not been the case in 2024, which has seen new hires shrink by a percentage point.

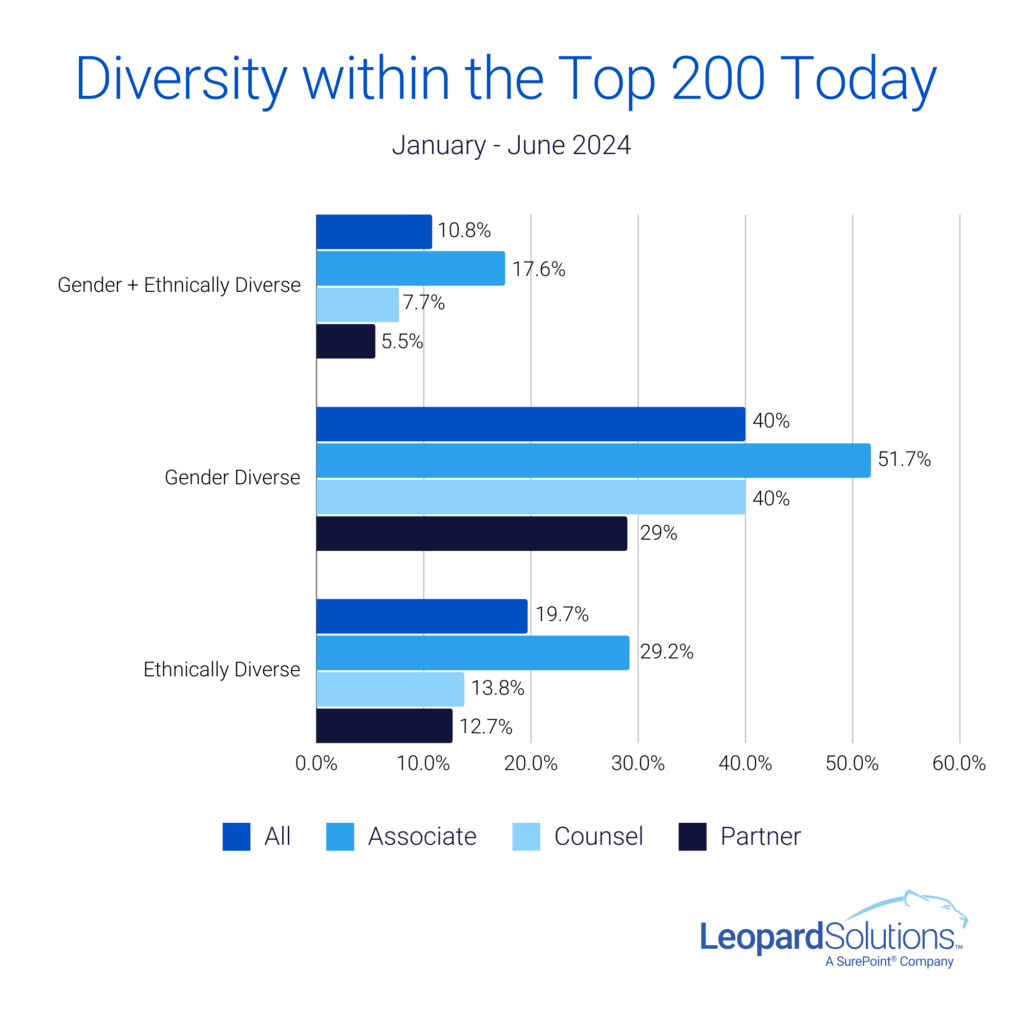

Diversity Progress Stalls within the Top 200 Today

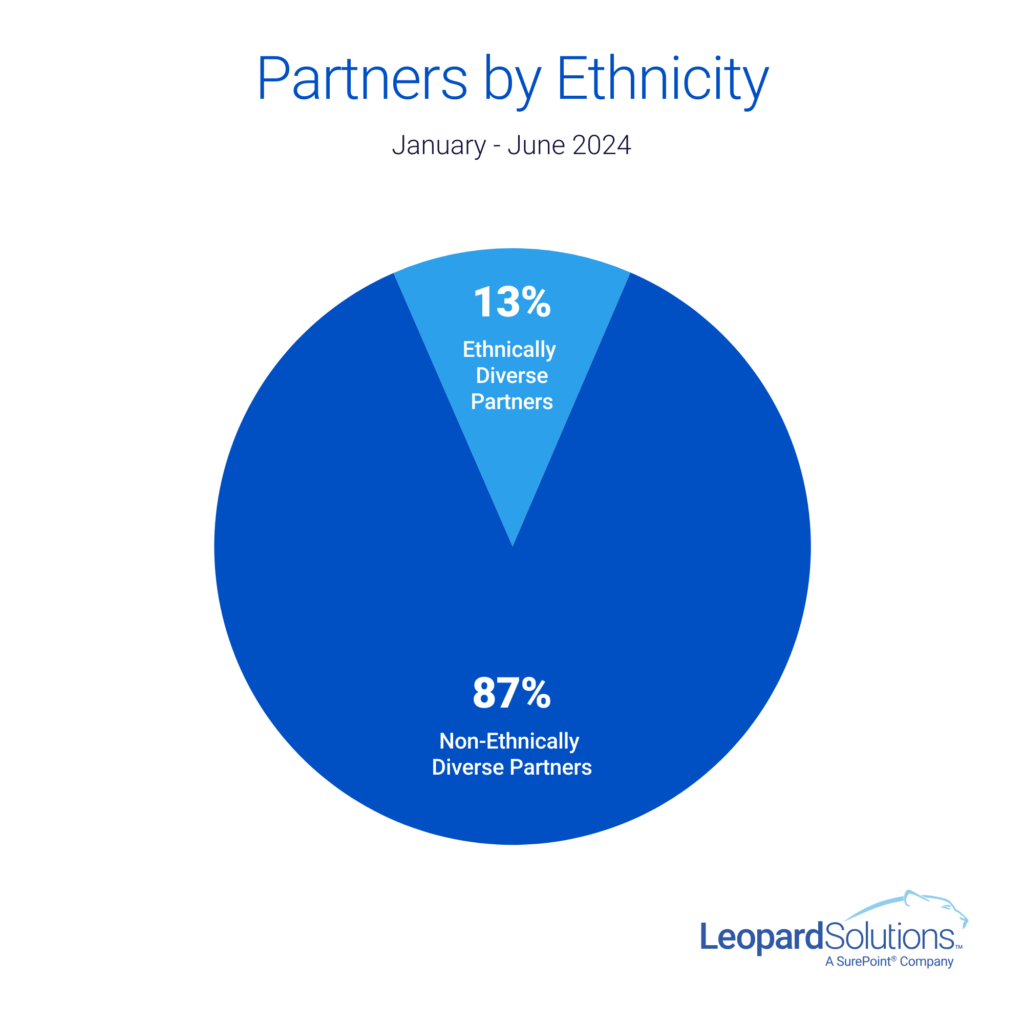

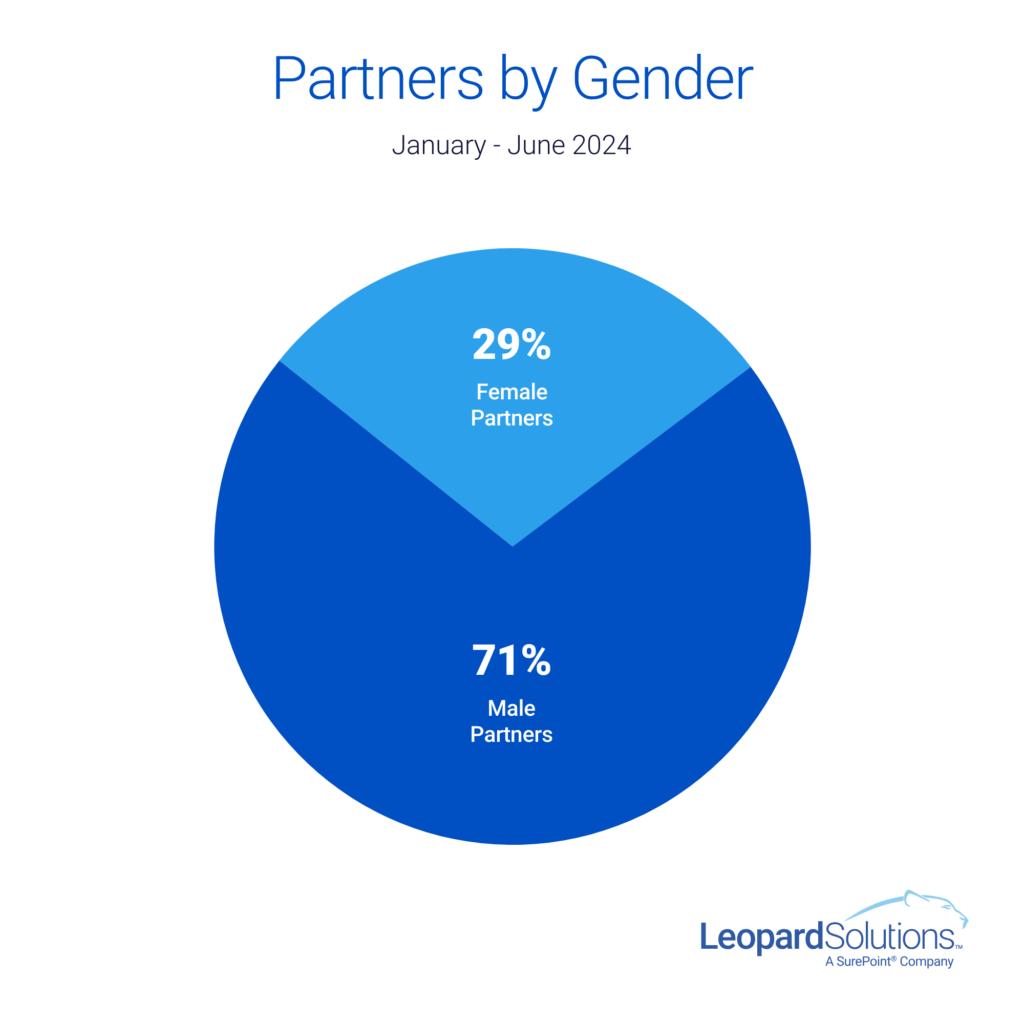

Of the Top 200 firms by gross revenue, 19.7% of attorneys meet the Leopard criteria for “ethnically diverse.” Women have overtaken men among the associate ranks, making up 51.7% of the population. There are more than double the gender-diverse partners (29%) compared to ethnically diverse partners (12.7%). Notably, only 5.5% of all partners are both gender and ethnically-diverse. Learn more about Leopard Solutions Diversity Probably Index.

Further drilled down by ethnicity and gender, the data reveals that only 12.7% of partners are ethnically diverse, while a significant 87.3% are non-ethnically diverse. Gender diversity shows that 29.0% of partners are female, compared to 71.0% who are male. This disparity highlights the underrepresentation of both ethnically diverse and female partners in top law firms, emphasizing the need for ongoing efforts to improve diversity and inclusion at the highest levels of the legal profession.

Practice Area Shifts

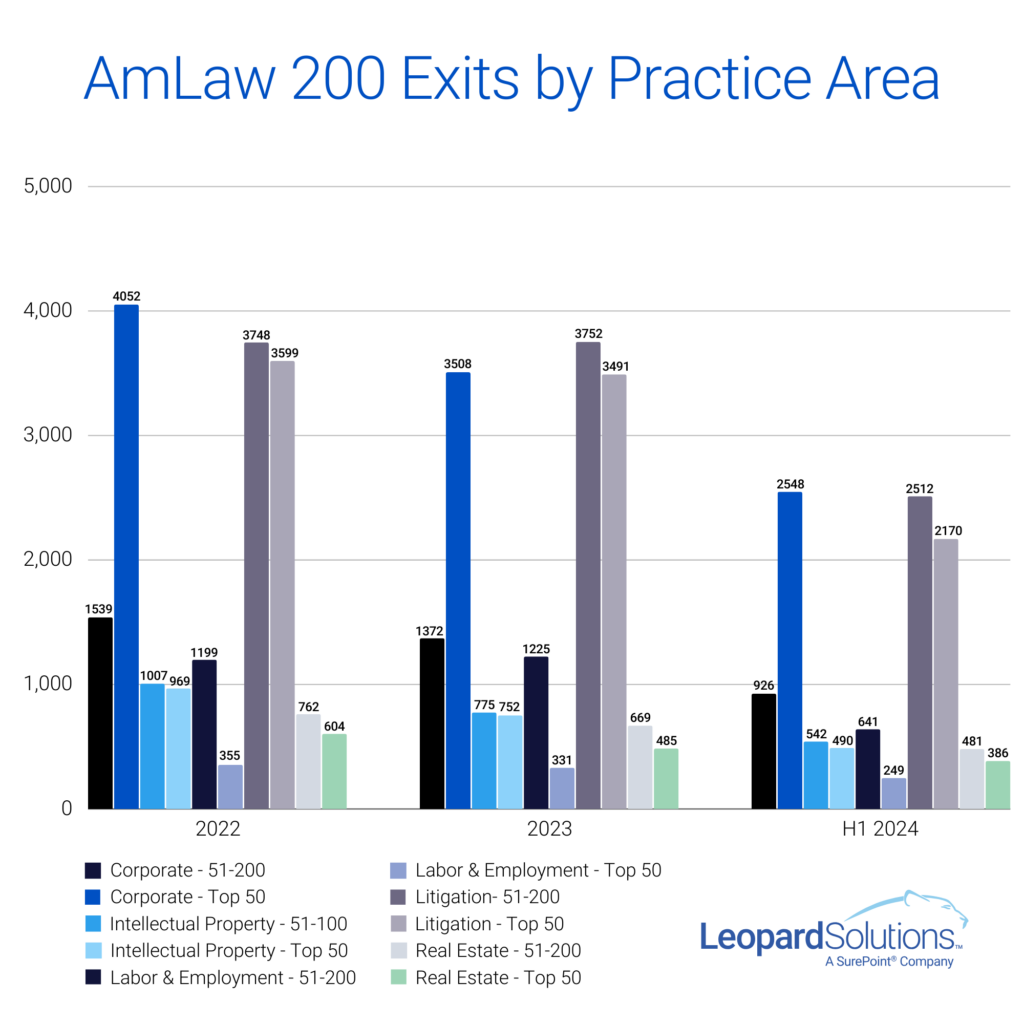

The composition of law firms is also evolving. Real estate and corporate practice areas have experienced higher-than-average attrition rates in the first half of 2024, suggesting a potential shift in client demand. Conversely, practice areas such as labor and employment, which saw a surge in demand during the pandemic, have experienced a slowdown.

Am Law 200 Exits by Practice Area – Number of Exits

Examining Am Law 50 and Am Law 51-200 attorney exit patterns across practice areas reveals notable trends. Top 50 firm real estate practices have already seen a higher percentage of attrition (4%) compared to the entire 2023 calendar year (3%). Similarly, corporate practices at the Top 50 firms have experienced 23% of defections, up from 21% in all of 2023. Of the 10 categories analyzed, half are 70% or more toward surpassing their 2023 fiscal year exit totals within the first six months of this year. Real estate among the Top 50 firms leads with 80% of its 2023 total, amounting to 386 exits. In contrast, Labor & Employment departures at 51-200 firms have slowed following 2023’s counter-cyclical practice boom, reaching just over half of the previous year’s 1,225 exits.

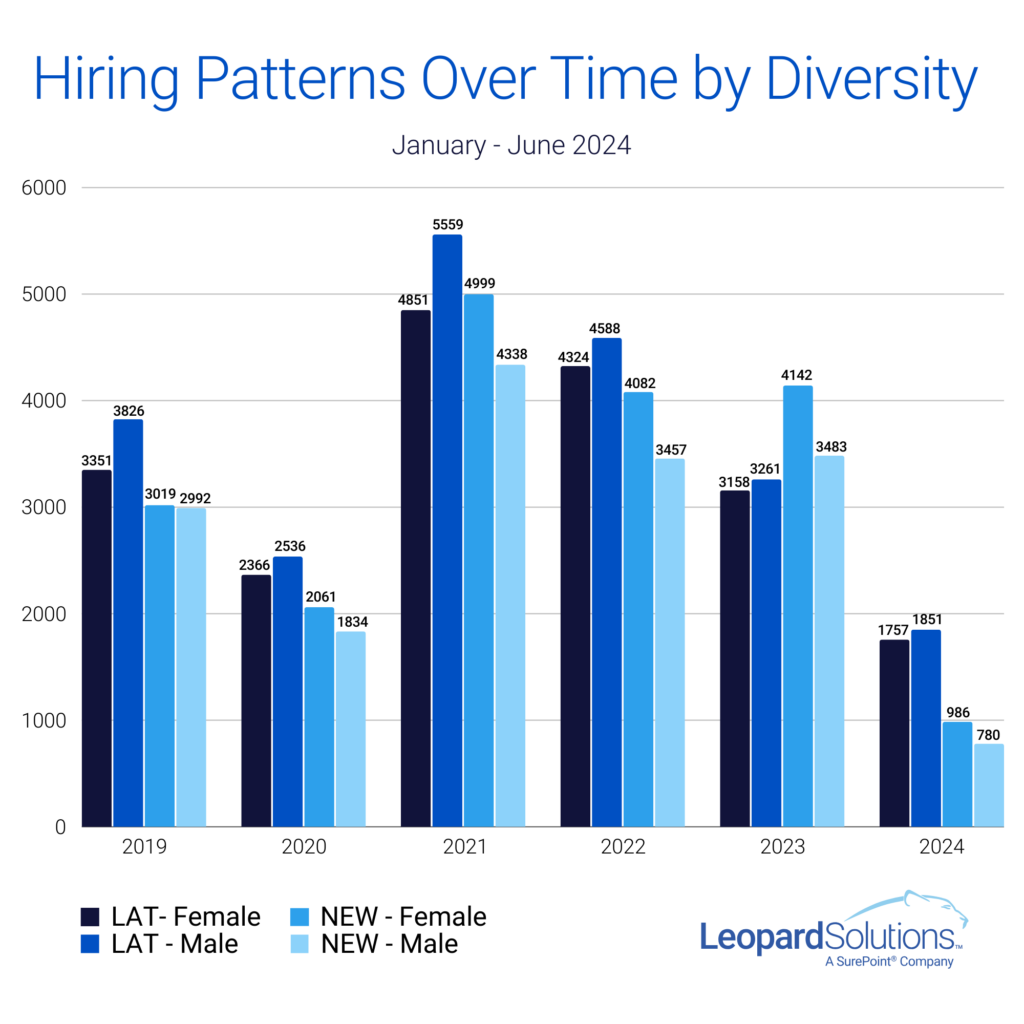

Hiring Patterns Over Time by Diversity

For the fifth consecutive year this decade, male attorney hires are outpacing their female counterparts in the lateral market, while women are surpassing men at the junior associate level. Last year was the first time in the 2020s that new female hires exceeded lateral male hires, but this seems to be an anomaly. Male lateral hires are trending at almost double that of females (1,851 compared to 986) through the first six months of 2024. The gap between lateral hires among genders has slightly tightened, with female hires trailing male hires by 103 last year and by 94 at the mid-year mark. New male hires are noticeably down this year (780), and even if their numbers were to quadruple in the second half of the year, they would still fall short of last year’s total (3,483).

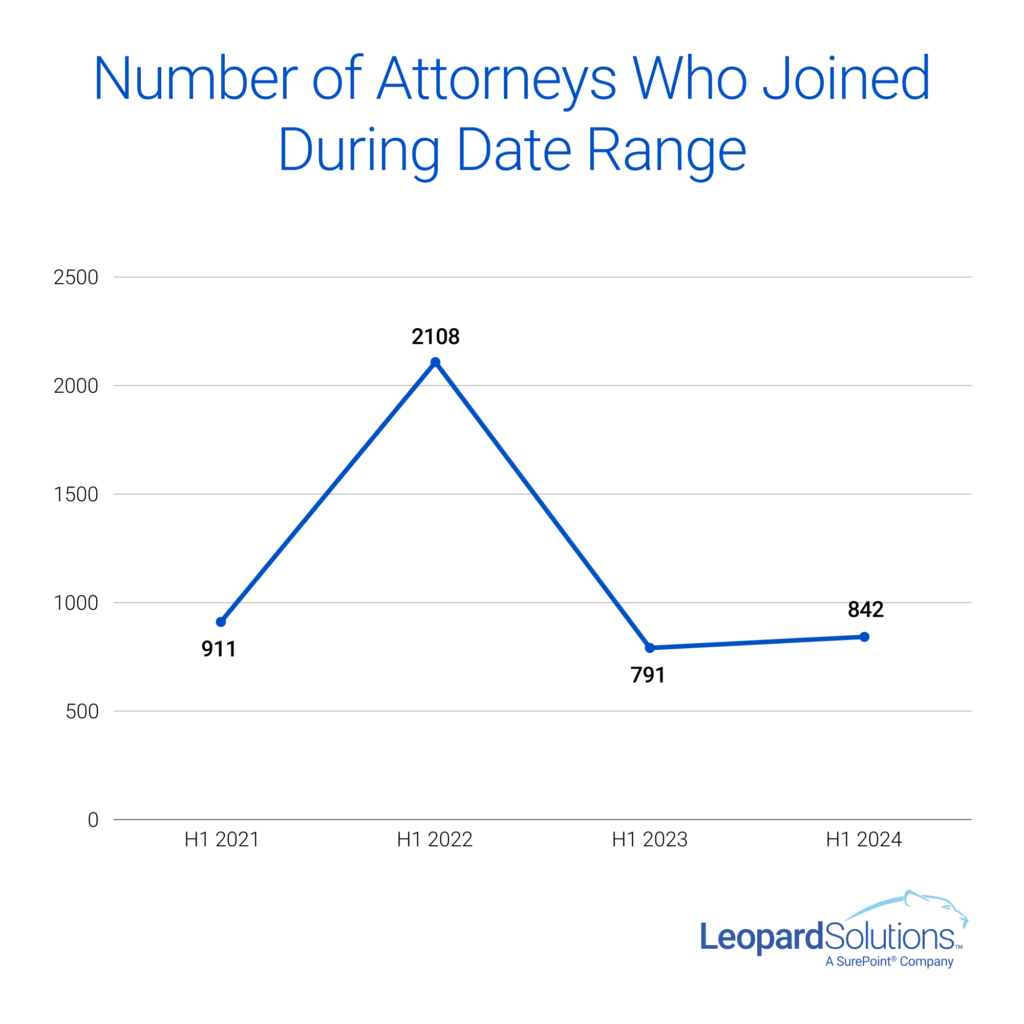

Lateral Hires in the Top 200 Firms

Overall, lateral hiring has been on the downswing each year since 2021, but this trend might reverse in 2024. As we enter July, we are already over 60% of the way to last year’s total of 10,694 lateral hires. Looking back to 2017, lateral hiring has only fallen below the 10k mark twice, with one of those instances being in 2020 due to the pandemic. The 2024 first-half figure of 6,459 lateral hires among all tracked firms represents 44% of the post-COVID hiring frenzy peak in 2021, which saw 14,792 hires.

Entry-Level Hires VS Lateral Hires in the Top 200 US Firms

Last year was the first time since 2017 that new hiring outstripped lateral hiring. However, this trend is set to reverse in 2024, as lateral hiring is running more than twice the rate of new hires, with 3,608 lateral hires compared to 1,766 new hires. By July 2024, new associate hires were only at 23% of the 2023 total of 7,625.

The Road Ahead

The legal industry is undoubtedly in a state of flux. While the challenges are significant, they also present opportunities for firms to adapt and thrive. Those that can effectively navigate these changes, focusing on talent retention, diversity and inclusion, and strategic growth, will be best positioned for long-term success. Leopard Solutions will continue to monitor these trends closely and provide insights to help law firms make informed decisions.

At a glance, highlighting the most dynamic shifts in business of law data over the past half-year.