In a recent Leopard Solutions webinar titled The State of Corporate Counsel Landscape: Trends and Opportunities, legal leaders came together to discuss the evolving role of in-house counsel amid shifting corporate demands and economic pressures. The conversation covered key insights from Leopard Solutions’ 2024 Corporate Counsel Salary & Lifestyle Survey, examining how in-house teams are responding to current challenges in compensation, insourcing, and the dynamics between internal teams and external law firms. Panelists included Zac Ferren, Executive Legal Recruiter and In-House Practice Leader at The Lion Group; Katherine Frierdich, General Counsel at Curative; and David Greer, General Counsel at C2FO. Their insights reveal how legal departments are adapting to market shifts, expanding skill sets, and becoming more self-sufficient in response to industry demands.

Evolving Roles and Responsibilities for In-House Counsel

As legal needs broaden within organizations, the in-house counsel role continues to evolve. Ferren highlighted a notable trend towards insourcing general business and corporate law functions, noting that “in-house roles often cover a variety of specialty areas,” such as real estate or corporate transactions. While litigation and employment law dominated in-house roles in the past year, there is now a visible shift back to more general corporate work and mergers and acquisitions (M&A) as deal activity appears poised to increase in 2025.

Echoing this, Greer shared his experience of bringing on a former litigator to his team, valuing the candidate’s analytical skills and writing expertise. “I feel like I can teach the corporate and business aspects,” Greer noted, appreciating the versatility that litigation backgrounds can bring to general counsel positions.

Frierdich’s team at Curative, a rapidly growing healthcare company, exemplifies the focus on insourcing and expanding internal expertise, especially in highly regulated areas like privacy. “We’re building out our privacy program,” she explained, emphasizing the importance of creating internal capacity and expertise to handle the organization’s specific needs. “Right now, we’re looking for expertise in contracting and privacy,” areas critical to the healthcare industry.

In-House vs. Law Firm Roles: Shifting Perspectives

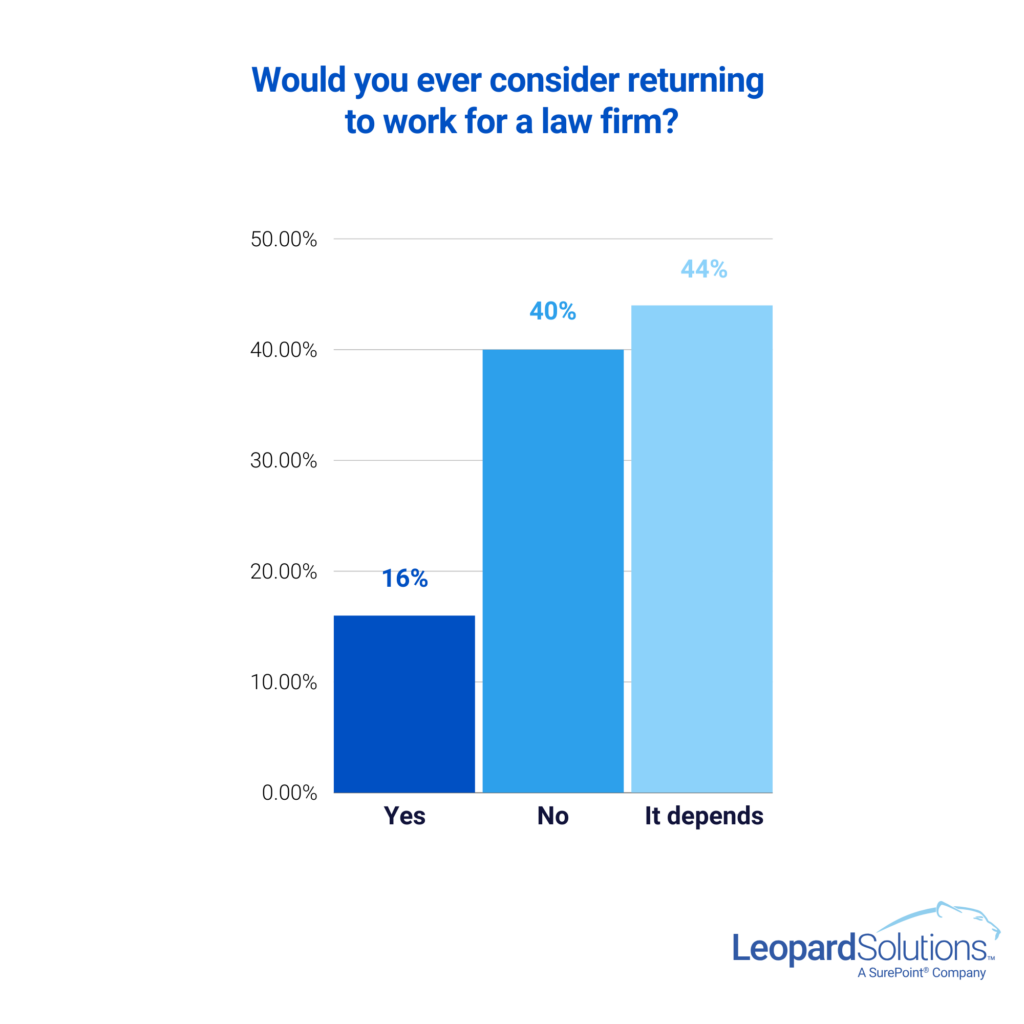

The conversation also addressed the dynamics of moving between in-house roles and law firm positions, with panelists noting the differences in work culture and compensation. Ferren observed that although some in-house attorneys are tempted by the higher pay at law firms, they often weigh this against the demands of billable hours and the intense work environment. “People might consider going back to a law firm,” Ferren remarked, “but unless law firm dynamics change significantly, it’s not a first or second option for most.”

Frierdich, who transitioned from the law firm Bryan Cave to in-house positions, highlighted her enjoyment of strategic work and leadership in a corporate setting. “I love setting strategy and leading litigation teams,” she said. Returning to a firm would only be an option if the role offered a unique business-side opportunity, she added. Greer echoed similar sentiments, noting that “the rates for outside counsel have surged, but at some point, the extra money isn’t worth it.” The consensus suggested that many attorneys, while aware of the financial incentives in law firm positions, prioritize the stability and work-life balance offered by in-house roles.

The Strategic Use of Outside Counsel and Value-Based Relationships

One critical area of discussion was how in-house teams are leveraging outside counsel. Although many legal departments cite tightening budgets as a reason for reducing reliance on external firms, recent survey data shows that 99% of organizations still hire outside counsel. This near-universal reliance raises questions about how such services are utilized effectively and where discrepancies between strategies and survey responses might arise. For example, while many legal departments emphasize cost control, the survey reveals that litigation dominates the practice areas sent to outside counsel, accounting for 54% of outsourced work. This suggests a continued reliance on external expertise for high stakes matters despite budgetary constraints.

Greer noted that his company uses outside counsel primarily for “sanity checks,” confirming internal decisions rather than delegating entire cases. This aligns with the survey’s emphasis on specific qualities valued in external counsel: responsiveness (88% rated it as very important), legal expertise (89%), and delivering value (77%). Meanwhile, Frierdich’s team focuses on obtaining “a very direct answer” to specific issues, underscoring a similarly strategic approach to controlling costs while maximizing the utility of external advice.

However, not all companies approach outside counsel in the same way. The survey data underscores this variability—while corporate/general business law (17%) and intellectual property (9%) are notable areas for outsourcing, labor and employment (8%) and other specialized fields like healthcare (1%) or tax (1%) show significantly lower engagement. This variation highlights how every company’s needs and approaches to external counsel are distinct, shaped by their industry, internal resources, and risk tolerance.

Both Greer and Frierdich emphasized the importance of long-standing relationships with trusted legal advisors. This is echoed in the survey, where 58% rated such relationships as somewhat important and 23% as very important. Frierdich shared that her team has shifted much of their work from high-cost coastal firms to more affordable Midwestern firms, which offer comparable expertise at reduced rates. This move aligns with a broader trend toward maximizing value without compromising quality—an approach reinforced by the survey’s findings that value (60%) and efficiency (70%) are top priorities when choosing outside counsel.

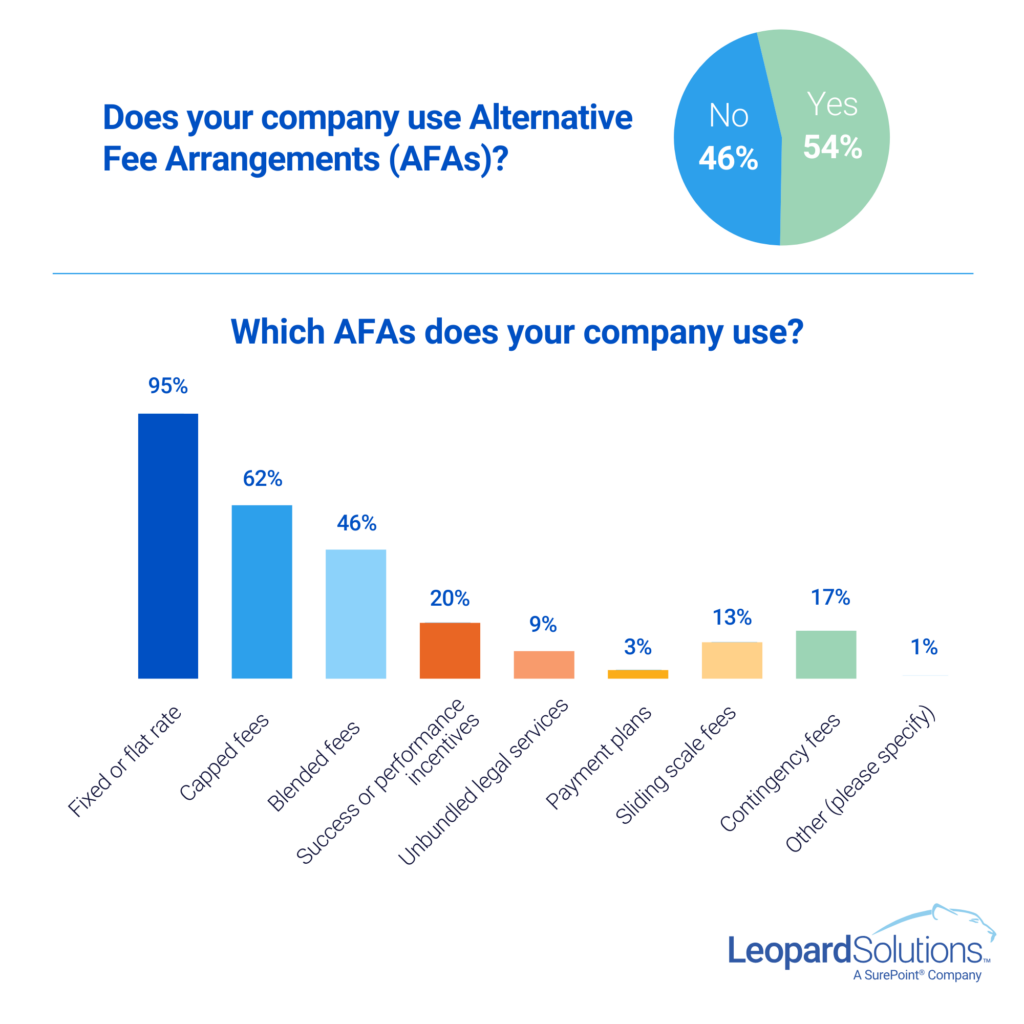

Controlling Legal Spend with Alternative Fee Arrangements

As legal costs increase, many in-house departments are turning to alternative fee arrangements (AFAs) to control expenses. Greer explained that his team has negotiated capped fees for discrete projects, especially when working with newer attorneys to ensure cost efficiency. “I think alternative fee arrangements are becoming more common,” he noted, citing a noticeable shift over the past few years as companies seek greater predictability in legal expenses.

Frierdich’s team has implemented various discount strategies, including volume-based discounts that escalate as spending increases. She explained the ongoing need to balance discounts against rising rates, stating, “it’s a negotiation every year to ensure we’re not losing our discount gains to rising fees.” Additionally, her team is piloting a blended rate agreement with one firm to see if it results in cost savings.

The Role of Technology and AI in Legal Departments

With technology advancing rapidly, in-house teams are considering AI tools for greater efficiency. While Frierdich acknowledged that tools like Ironclad and Conga are becoming more advanced with AI functionalities, her team approaches adoption cautiously, especially given privacy concerns in the healthcare industry. “We’re very locked down on AI right now,” she stated, explaining that they carefully monitor information flow to ensure data security and compliance with industry regulations. Greer’s team, on the other hand, has not yet implemented AI but recognizes its potential for future efficiency.

Moving Forward: A Strategic Focus on Value and Efficiency

The panelists collectively indicated a strong focus on efficiency and budget optimization for the year ahead. With corporate legal departments often working with fewer resources, in-house teams are increasingly strategic about the work they choose to keep internal versus sending to outside counsel. Ferren noted that flexibility in staffing solutions, such as the use of fractional general counsel services, has emerged as an alternative, especially for companies with variable workloads or temporary staffing needs.

The 2024 legal landscape will likely demand even greater adaptability from in-house teams. As companies prioritize cost-effective legal solutions, the ability to insource work, control budgets through AFAs, and leverage technology will be critical in helping legal departments align with business priorities. For law firms looking to remain competitive, the panelists underscored the importance of understanding and adapting to these changing dynamics, as value and efficiency will be at the forefront of in-house counsel decisions in the coming year.