Stability at the Top, But Growth in Openings Slows Year-Over-Year

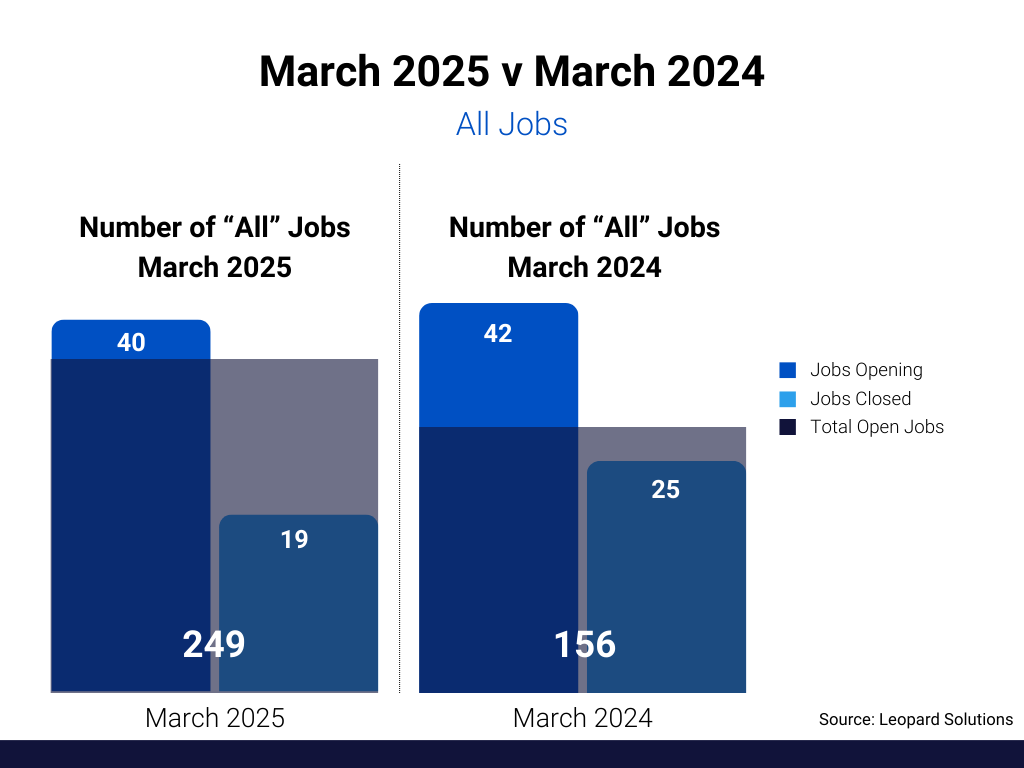

March 2025 saw relatively steady legal job market activity compared to the same month last year, but the pace of new openings appears to be slowing. Across all firms, there were 40 job openings and 19 closings during the month, bringing the total number of open roles to 249.

That’s a notable 60% increase in open positions from March 2024, which ended with just 156 open jobs—despite slightly more openings (42) and closings (25) last year.

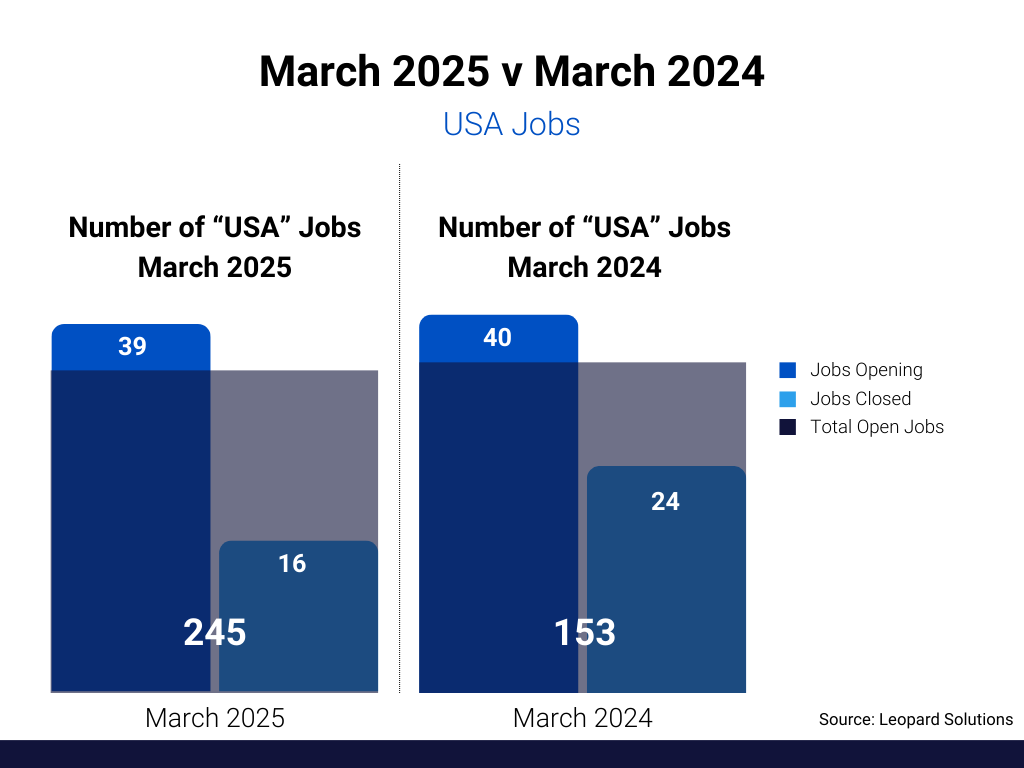

The trend holds for U.S. firms specifically. In March 2025, they reported 39 job openings and 16 closures, with 245 total open jobs—up sharply from 153 open jobs in March 2024. That increase comes even though job activity was nearly identical year over year in terms of openings (40 in 2024 vs. 39 in 2025) and closings (24 vs. 16).

Hiring Pace Holds, But Unfilled Roles Pile Up

Bottom line: while the number of new postings has remained stable, the real story is the accumulation of unfilled roles. It may point to more selective hiring—or difficulties finding the right candidates in a changing legal landscape. With political and economic uncertainties looming, the rise in open roles suggests firms are approaching hiring with a mix of cautious optimism and strategic hesitation.

Macro Trends: Cracks in the Consumer Foundation

U.S. private employers added 184,000 jobs in March, driven by demand in hospitality, construction, and leisure, according to ADP. But wage growth for workers staying in their jobs dropped to 5.1%—its lowest pace in more than three years—indicating a cooling labor market. As employers ease up on aggressive pay increases, particularly in lower-wage sectors, consumer spending could lose momentum, just as tariff-related price hikes loom. The job market isn’t collapsing, but the balance of power is shifting—with ripple effects likely across retail, housing, and services.

Market Watch: Political Fallout and Economic Whiplash Collide

The end of Q1 still looked rosy compared to the same time last year, but we’ll be watching closely as the effects of tariff turbulence and fallout from the Trump “enemies list” begin to play out. Some firms have cut deals; others are pushing back. The ripple effects—especially among incoming associates and lateral candidates with strong feelings—are starting to show up this April.

Wall Street and many BigLaw firms had built forecasts on Trump-era promises of deregulation and a booming deal environment. But with a self-inflicted bear market and belt-tightening on the horizon, firms may be forced to make real-time decisions about staffing. Stay tuned—we’ll be tracking how it plays out in the data.

Methodology Note

Leopard Solutions is continuously expanding, adding new firms to our Leopard List and Jobs platforms. To ensure accuracy in year-over-year comparisons, this report is based on a consistent cohort of 1,100+ B2B, U.S.-centric firms tracked since the beginning of the reporting period. This method ensures that the trends reflect true market shifts, not database growth.

For more insights on legal job trends and hiring activity, visit Leopard Jobs.