Bryan Cave Leighton Paisner LLP (BCLP) is no stranger to scaling up. The firm, formerly Bryan Cave and Berwin Leighton Paisner, officially launched its unified format in April 2018. The resulting global, fully integrated law firm boasted over 30 offices across North America, Europe, the Middle East, and Asia, headquartered in St. Louis, Missouri. With more than 1,600 lawyers, it is among the largest in the world, enabling it to enhance the scope of services provided to its clients significantly. The firm currently represents 30 of the world’s top 50 banks.

On paper, it was a match made in M&A heaven, but in practice, attrition has reared its ugly head. In the subsequent years since joining entities, BCLP has dealt with high-profile partner departures, middling retention, defections to rival firms, leadership transitions, and headaches that come with trying to integrate a Swiss Verein. While it has not all been doom and gloom—they did manage to absorb a 12-lawyer litigation boutique in Seattle, allowing them to establish a sorely needed footprint in the Pacific Northwest in April of this year—it is fair to say the marriage has been at times rocky.

Fast forward to today, recent reporting by Law360 suggests they are once again in the market for a merger partner, badly wanting to stem the tide of departures, a charge which they sought to dispel after publication. Still, the data is the data, and despite past hiccups, an acquirer could prove beneficial. Using Leopard Solutions’ Mergers and Acquisitions prognosticative tool, we were able to play a bit of “law firm fantasy football” to see if there were any suitable unions out there that could improve their fortunes.

Why a Merger?

Picking a merger partner is a lot like picking a VP running mate. The first criterion should be to do no harm, and the next should be to fortify areas of need or, for the sake of analogy, bring in new coalitions.

The Specs

For this exercise, these are the specifications we input to help identify a matching partner and why:

Location: According to the Leopard Solutions’ Laterals by Destination report, dating back to the inception of the merger that formed BCLP, the firm has experienced a negative lateral differential (meaning they lost more than they brought on) across all offices except the recently annexed Seattle and Charlotte (which posted a net “0”). We selected the three with the highest attrition: St. Louis (-73), New York (-34), and Atlanta (-24).

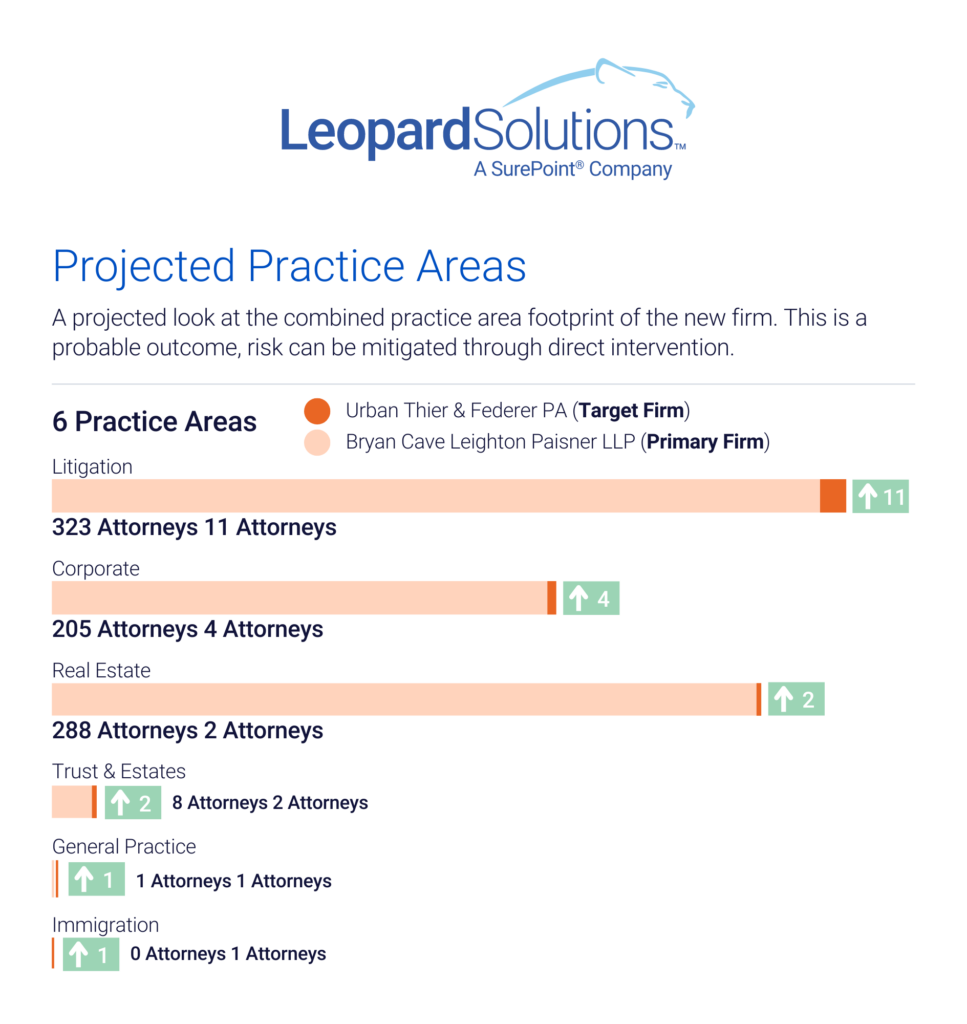

Practice Areas: BCLP had six practice groups with double-digit negative lateral differentials going back to April of 2018. They were Litigation (-131), Corporate (-84), Bankruptcy (-24), Real Estate (-16), Labor & Employment (-13), and Environment (-11).

Specialties: Next, we pinpointed four specialties with negative lateral differentials of more than 50. They were Mergers & Acquisitions (-78), Securities (-75), Contracts (-63), and Finance (-56).

Diversity: According to Leopard’s diversity matrix, BCLP currently comprises 12% high probability diverse attorneys and support staff. With that in mind, we used 13% as a minimum diversity benchmark for a merger partner, feeling it best to at worst increase in that rubric.

And the Best Matches Were (Drumroll Please) …

Urban Thier & Federer PA Urban Thier & Federer PA is an international law firm focused on providing legal services to businesses and individuals requiring expertise in United States, German, European Union, and United Kingdom laws.

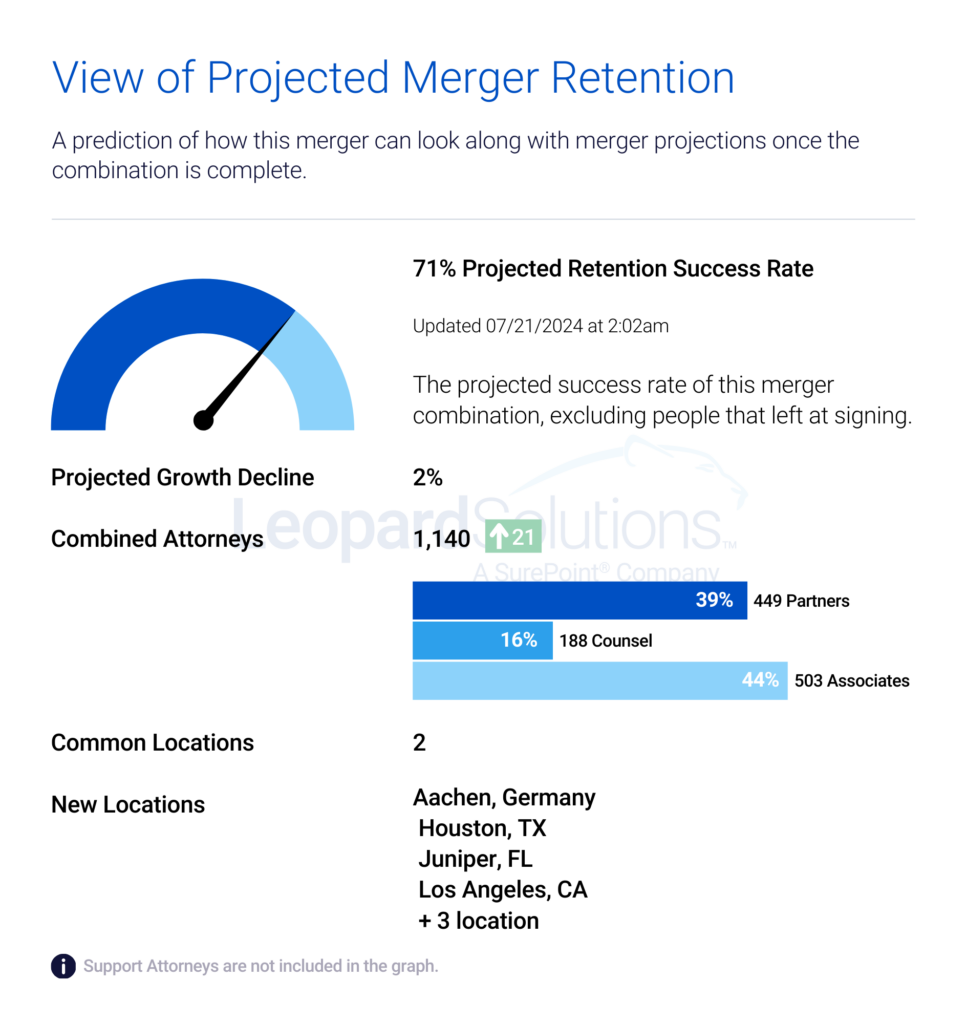

How BCLP Fares in the Aftermath:

Growth

If we were to add a 37% gender diversity minimum into our synergy soup, one percentage point above where BCLP currently stands for high probability gender diversity, another strong target firm candidate emerges:

Wong Fleming PC

Established in 1994, Wong Fleming has expanded into a comprehensive law firm with offices across the United States, Canada, and Germany. It holds certifications as a minority business enterprise by the National Minority Supplier Development Council and as a woman-owned business by the Women’s Business Enterprise National Council.

In this scenario, there would be a 64% projected success rate of this merger combination, excluding those who left at signing.

Finally, were we to add one more variable into the mix, specifically a firm leverage of 1-5 (BCLP’s is reportedly 3.4), another strong candidate emerges: Alston & Bird.

Alston & Bird also features a headcount just shy of a thousand (951), comparable to the size of the mystery firm reportedly approached for a merger, which was rejected according to Law360.

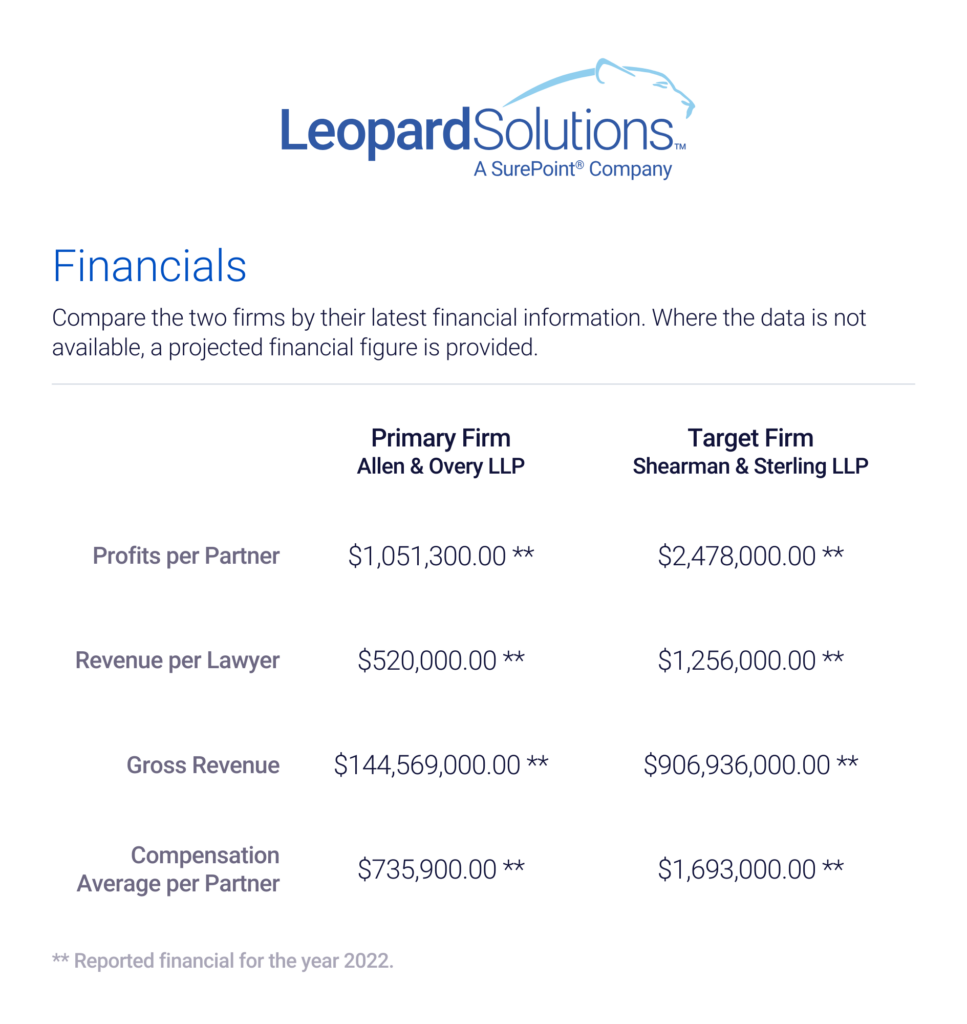

If this merger were to happen, it would create an industry juggernaut with a whopping 84% projected growth potential. Additionally, it promises some tantalizing financials:

Leveraging a Good Leverage Ratio

Leading firms excel not only in utilizing leverage but also in strategically positioning it for maximum benefit. For many partners, their primary responsibility is to generate business for the firm. A high leverage ratio can signal significant capacity for billable work, potentially leading to high profits per partner if managed effectively. However, improper management of high leverage can result in inefficiencies, low morale, and reduced service quality. Firms must ensure there is sufficient work to keep all associates engaged and provide adequate mentoring and supervision from partners. Additionally, firms need to manage their non-equity partners similarly to their associates. If salaries increase while billing rates plateau or billable hours decline, profit margins for the non-equity partnership group will shrink over time.

In 2023, there were approximately 51 law firm mergers. We maintain a continuous scorecard to monitor attrition following these mergers, encompassing both small firms with 6, 15, or 25 attorneys and larger, more notable mergers. Small strategic acquisitions are occurring alongside larger strategic group moves, with recruitment efforts focused on bringing in larger numbers of attorneys at once. The success rate of law firm mergers is relatively low, with studies indicating that about 50% of law firm mergers do not achieve their intended goals. Mergers rarely serve as a life preserver and should only be employed as part of a long-term value proposition.

The Bottom Line

The merger of Bryan Cave LLP and Berwin Leighton Paisner LLP exemplified a successful strategic move: Bryan Cave was strong in the United States, while Berwin Leighton Paisner had a significant presence in the UK and Europe. The merger extended both firms’ geographic reach and client base. Post-merger, BCLP demonstrated positive revenue growth and increased profitability, with a clear focus on client service and innovation. While it is important to continue leveraging these successful aspects, a thoughtful approach is required to ensure sustained success.