According to a recent study titled “Decoding Legal Talent Mobility in the Age of Data,” the anticipated law firm lateral movement will decrease again in 2024. This projection follows a remarkable surge in lateral hiring observed in 2021 and 2022. However, the study’s year-end findings for 2023 indicate a significant decrease, with a 26% decline in partner lateral moves between 2022 and 2023 and a notable 35% decrease at the associate level. According to the report, which looks at movement among mostly large and midsize law firms, partner moves are likely to drop 8% year-over-year in 2024, and associate moves are expected to fall by 12%.

Despite experiencing declines for two consecutive years, the overall figures recorded last year and those projected for this year still exceed the averages observed in the three years before the onset of the pandemic.

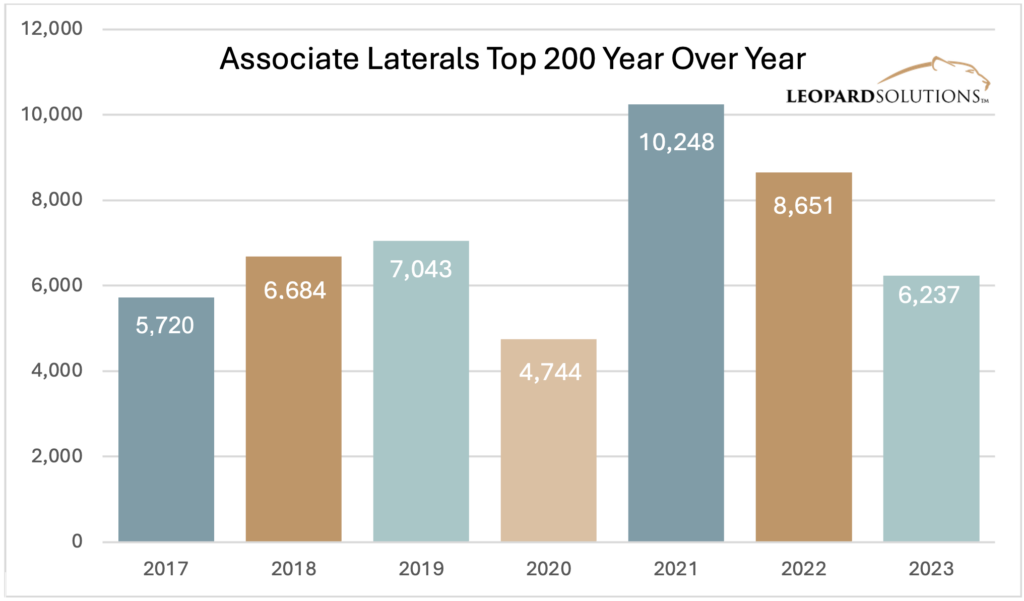

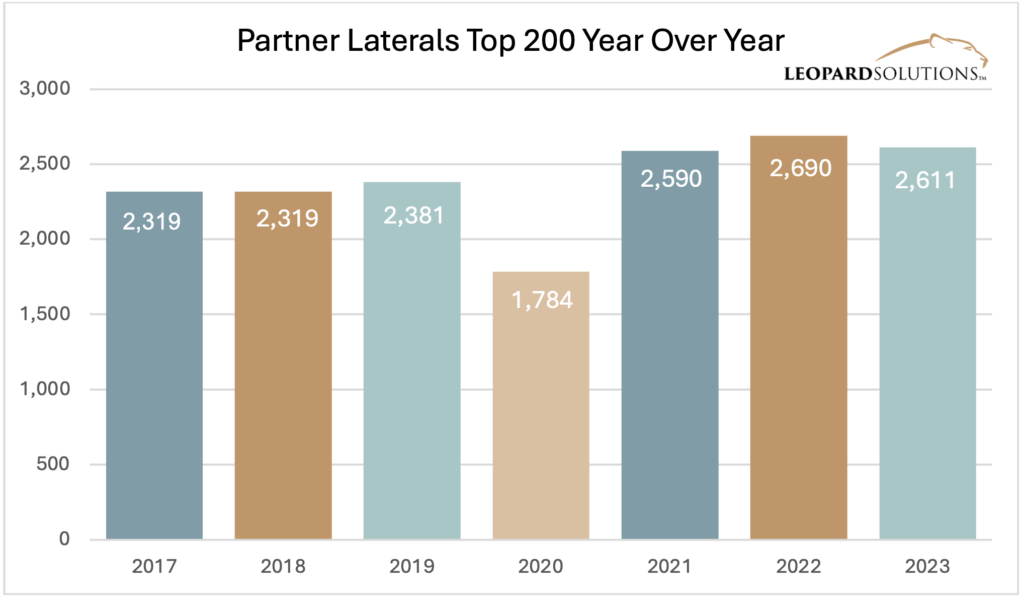

Leopard Solutions’ data, despite aligning with the post-pandemic hiring surge, presents a notably different narrative regarding lateral movement among partners from 2022 to 2023, showing a far less drastic decrease (2.9%). Similarly, Leopard’s dip in associate hires, while closer to the figure in the report, is notably smaller (28% compared to 35%). In stark contrast, Leopard’s partner lateral figures did not exhibit two consecutive years of decline leading up to 2023; in fact, the 2022 figure (2,690) surpassed that of 2021 (2,590).

Regarding associates, Leopard Solutions’ total for 2023 did not surpass those of the pre-COVID years, 2018 and 2019, as illustrated in the report. While not a perfect apples-to-apples comparison due to the somewhat ambiguous universe of mostly large and midsize firms referenced in the report, the charts below from Leopard Solutions utilized the closed set of Am Law 200 firms, which represents as ubiquitous a sample of BigLaw as exists.

We are assessing the hiring trends within the current slate of Top 200 ranked firms, rather than focusing on historical data. Our analysis is centered on tracking the hiring activities of this specific group of firms.

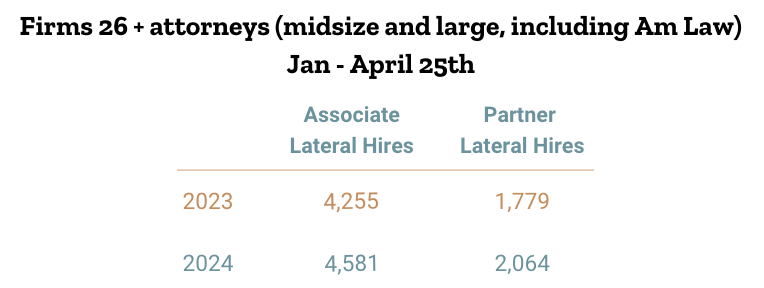

To make an informed prediction of future trends, Leopard Solutions conducted year-over-year comparisons of Q1 timeframes. One analysis included an industry-accepted approximation of a midsize firm, followed by culling those within those parameters from the Leopard Solutions database. Associate lateral hiring has decreased from pre-pandemic levels. However, graduate hiring has surged and has surpassed associate lateral hiring for the first time in several years, according to our State of the Industry report. Partner hiring continues to exceed pre-pandemic levels and is expected to reach or even surpass the levels seen in 2023.

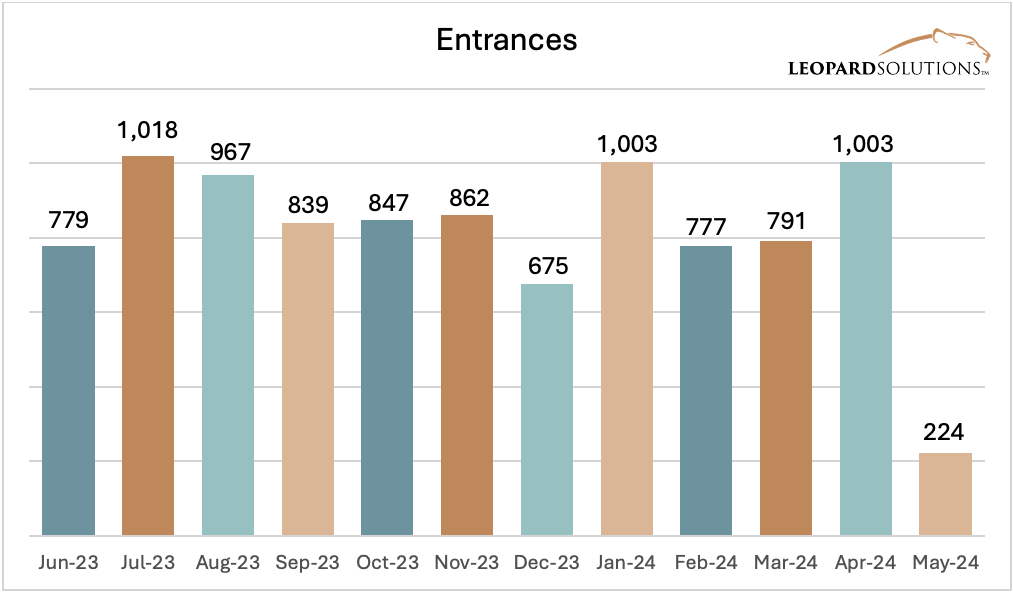

A recent Law360 article titled “Law Firm Lateral Movement Expected To Fall Again In 2024” cites the report, which suggests that the pace of lateral movement, particularly at the partner level, is unlikely to fully return to pre-pandemic norms due to increased lateral mobility within the legal profession. However, as illustrated by the chart below, Leopard Solutions’ data does not entirely support this assertion. A more holistic breakdown of 2024 lateral entrances among associates, counsel, and partners showed April numbers crested to a high water mark, tying January for the best of 2024. Similarly, while the article expects law firms to continue prioritizing the hiring of partners with established books of business, this overlooks the significant shift towards entry-level hiring surpassing lateral hiring within the industry. Data accuracy is an essential component of being able to forecast future outcomes. Without a sufficient understanding of past performance and variables, attempts at predictions are fundamentally flawed.

Despite a decline from peak lateral hiring, firms effectively offset revenue losses through heightened billing rates. A recent survey conducted by Wells Fargo on Q1 law firm performance revealed significant growth in demand and billing rates, particularly noticeable among larger firms. This surge resulted in revenue gains that more than doubled compared to the same period last year. According to Wells Fargo’s Legal Specialty Group, there was a notable 9.5% increase in revenue across Am Law 200 firms in Q1. This growth was propelled by heightened demand, supported by a resurgence in capital markets, substantial mergers and acquisitions activities, and continued momentum in countercyclical work.