A recent Bloomberg Law article, Polsinelli’s ‘Goldilocks’ Stretch Has Firm Targeting Mid-Markets, highlights the firm’s impressive growth trajectory and preference for strategic lateral hiring over mergers and acquisitions (M&A). With nearly $1 billion in revenue and an 11% growth rate over the past year, Polsinelli’s success underscores a broader industry trend: firms are increasingly favoring lateral recruitment as a primary expansion strategy. This article examines the data supporting this shift and why lateral hiring generally outperforms mergers in terms of attorney retention and firm stability.

The 2024 Lateral Partner Hiring Survey, conducted in partnership with Leopard Solutions and Wisnik Career Enterprises, confirms that lateral hiring has become a dominant force in legal recruitment. A striking 69% of firms now proactively identify and source lateral candidates, signaling a major shift from traditional hiring models. Additionally, 64% of firms emphasize strategic hiring alignment with long-term goals, prioritizing targeted expertise over broad-based expansion. The financial investment in lateral hiring is substantial, with the average law firm budget for lateral partner hiring surpassing $4 million, and 54% of firms stating that lateral hiring will be their primary growth driver in 2025. These statistics illustrate how law firms are investing heavily in lateral hiring to secure top talent, rather than relying on mergers that introduce operational inefficiencies and cultural mismatches.

Retention Analysis: Lateral Hiring vs. Mergers

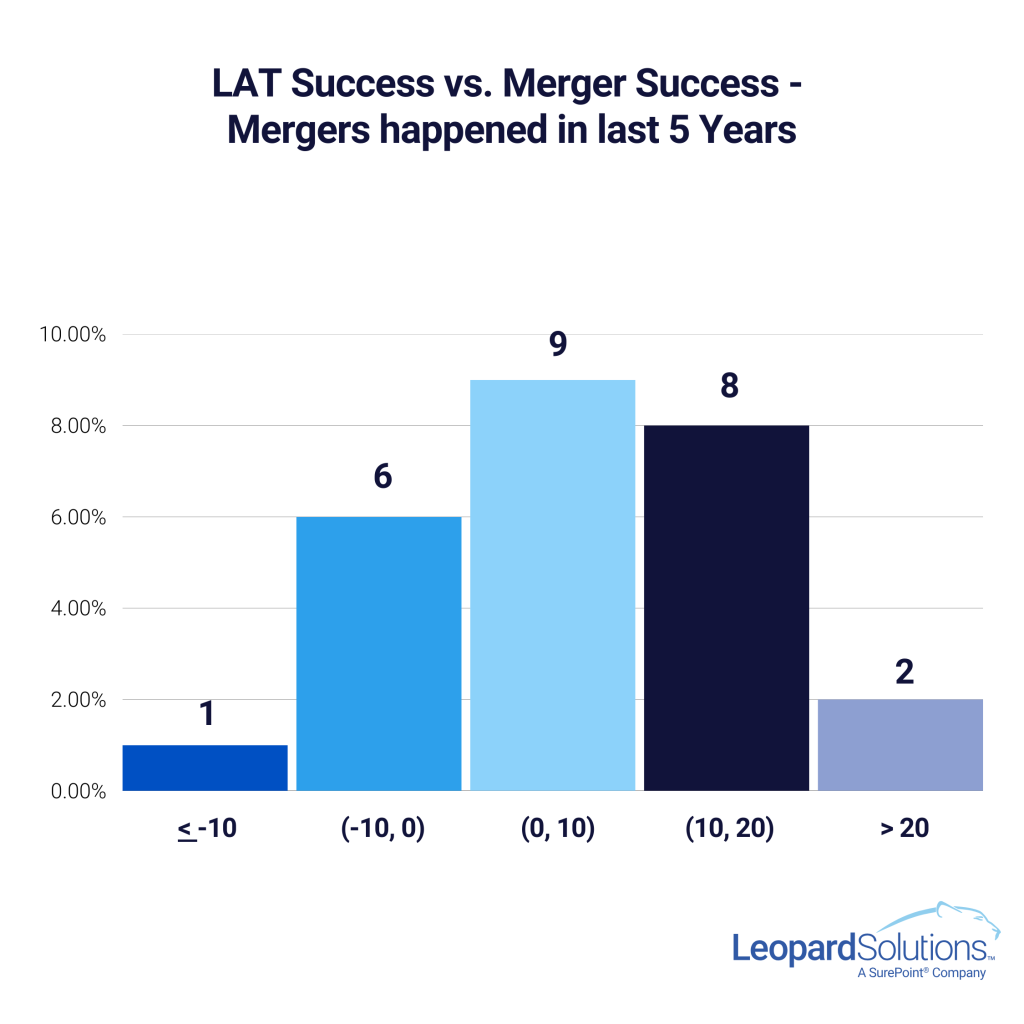

Leopard Solutions analyzed data from 26 law firm mergers over five years (excluding acquisitions) to assess attorney retention rates compared to those achieved through strategic lateral hiring. The results highlight the superior retention benefits of lateral hiring:

- Retention Trends:

- 19 firms (73%) achieved higher retention via strategic lateral hires.

- 7 firms (27%) had better retention through mergers.

- Differential Insights:

- One firm, Hand Arendall, LC, retained 92% of 63 attorneys from a merger but only 68% of 28 lateral hires, showing a negative differential of 22.

- Among firms with better merger outcomes, six had a retention differential between -10 and 0.

- Of the 19 firms favoring laterals:

- 9 showed a differential of 1–10.

- 8 showed a differential of 11–20.

- 2 exceeded a differential of 21:

- Berrymans Lace Mawer: 90% retention for 191 lateral hires vs. 57% for a 2022 merger.

- Brinks Gilson & Lione: 87% retention for 176 lateral hires.

- Notable Performances:

- Worst Merger Performance: Pepper Hamilton’s 2020 merger retained only 54% of 459 acquired attorneys.

- Best Lateral Performance (for firms with over 300 hires): Waller Lansden Dortch & Davis retained 90% of 306 lateral hires.

The Case for Lateral Hiring

This analysis reinforces that strategic lateral hiring provides better short-term retention than mergers, making it an attractive option for law firms looking for stability and sustainable growth. While mergers can be effective for market dominance, diversification, or leadership succession, they often come with integration challenges and higher attrition rates. Conversely, lateral hiring allows firms to selectively add top talent with existing client relationships, ensuring a smoother cultural fit and more immediate contributions to firm revenue.

Polsinelli’s deliberate strategy of lateral hiring over mergers has yielded remarkable results, as highlighted in the Leopard Law Firm Index. The firm experienced 11% growth last year and maintained a perfect tenure score of 1000 out of 1000, reflecting its ability to retain attorneys effectively. Polsinelli also excels in diversity, with 16.1% ethnic diversity and 29.5% of its partners being women. The firm’s return on investment (ROI) for lateral hires stands at an impressive 98.2%, with an ROI of 100% for entry-level hires. Additionally, promotions to partner occur at a rate of 5.7%. By strategically expanding in high-growth areas such as health care and real estate, Polsinelli has positioned itself as a go-to firm for transactional, regulatory, and advisory services. Unlike many firms that have struggled post-merger, Polsinelli’s targeted approach has allowed it to maintain high retention rates and profitability.

Strategic Expansion: Choosing the Right Path

If a firm needs rapid market expansion, a merger might be the right move. However, if the goal is long-term stability, strategic growth, and higher retention, lateral hiring is often the smarter play. The key to success, regardless of the approach, is careful planning and cultural integration. Firms that prioritize these elements can maximize the benefits of their chosen growth strategy while minimizing potential disruptions.

Given the latest data trends, more firms are likely to follow Polsinelli’s lead, making lateral hiring the dominant strategy for law firm expansion in the years ahead.