Announced in May 2023 and slated to conclude nearly a year later, the merger between Allen & Overy and Shearman & Sterling stands out as one of the most prominent consolidations in recent memory within BigLaw megafirms. Described in the press release as the birth of A&O Shearman, the union aims to create a legal powerhouse proficient in US law, English law, and the regulations of the world’s most vibrant markets. With approximately 3,950 lawyers and 800 partners spread across 48 offices, boasting a combined revenue of around $3.5 billion, and showcasing some of the finest legal minds globally, this fusion, bringing together 241 years of collective legal experience, garnered near-unanimous approval from shareholders, with over 99% of votes in favor from both firms. So, how did this momentous collaboration come about?

For UK-based firms like Allen & Overy, venturing into the US market has been a longstanding ambition. Previous attempts fell short, hampered by a lack of scale necessary to compete, particularly in the litigation sphere, despite efforts to recruit US lawyers from rival firms. On the other hand, Shearman & Sterling sought to bolster its international footprint beyond its overseas presence while grappling with financial hurdles brought on by unfunded pension commitments and a couple of waves of layoffs. Both firms also contended with the aftermath of unsuccessful merger endeavors: Shearman’s proposed union with Hogan Lovells fizzled out, while Allen & Overy’s 2007 integration discussions with O’Melveny & Myers ultimately came to naught.

The honeymoon period of the new entity hasn’t been without its challenges, particularly in navigating succession issues stemming from the departure of key figures like A&O Managing Partner Gareth Price and esteemed rainmaker Wim Dejonghe, who was anticipated to play a pivotal role in the firm’s transition. Despite these setbacks, AO Shearman is poised to establish its headquarters in Shearman’s pre-merger New York office. New leadership appointments were announced on March 1, with A&O’s Khalid Garousha assuming the role of senior partner of the combined firm and Hervé Ekué being appointed managing partner, bringing a blend of leadership experience to the table. Shearman’s Adam Hakki and Doreen Lilienfeld will also take on key roles within the merged entity, contributing their expertise to steer the US business forward.

So, what can we anticipate from this transformative merger between two transatlantic blue-chip firms? With insights from Leopard Solutions’ predictive mergers and acquisitions tool, which leverages data-driven algorithms and nearly twenty years of attorney and law firm research, we gain a nuanced understanding of the potential success of this combination. It’s not merely a straightforward 1 + 1 assessment; the tool analyzes attorney patterns, merger history, and other factors to forecast attrition rates and gauge the likelihood of success. By providing a comprehensive view of potential partners and highlighting financial, client, cultural, and attorney retention complexities, the Leopard M&A tool equips firms with the insights needed to make informed decisions and identify areas where additional mitigation efforts may be necessary.

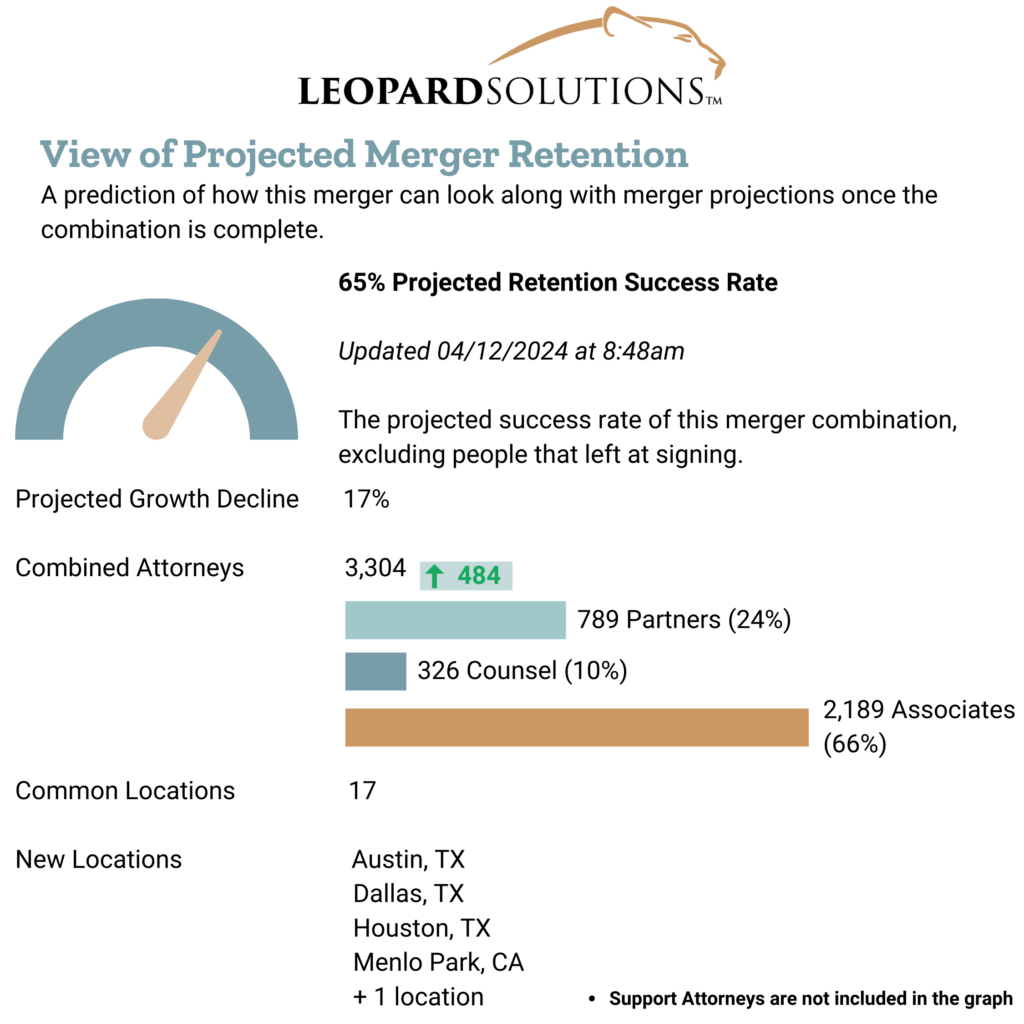

Based on that report, here is what we gleaned from a view of projected merger retention:

- Projected Merger Retention:

The projected retention success rate of 64% suggests that a significant number of lawyers from Allen & Overy and Shearman & Sterling are expected to depart post-merger. Though, comparatively, it indicates a reasonable confidence level in the merger’s ability to retain talent.

To provide context, we looked back to 2017 and compared AO Shearman’s projected retention success rate to that of seven mergers of similar scope, where we now have the hindsight to evaluate their outcomes. At 64%, AO Shearman’s projection places them one percentage point below the average retention rate of 65% and three percentage points below the median of 67%.

Leopard Solutions AI analyzes the outcomes of past mergers and combinations to serve as a benchmark for calculating the success or failure of two firms merging or combining. While this projection represents a likely outcome, risks can be mitigated through direct intervention. A firm’s retention success score is determined by the projected number of lawyers expected to depart the firm within a four-year period.

AO Shearman’s projected retention success rate of 64% falls within the range of retention success rates observed in other notable law firm mergers. Compared to Norton Rose Fulbright + Chadbourne & Parke LLP, which achieved a retention success rate of 61%, AO Shearman’s projected rate is slightly higher. Holland & Knight LLP + Thompson & Knight LLP achieved a higher retention success rate of 73%. Faegre Drinker Biddle & Reath LLP + Drinker Biddle & Reath LLP reported a retention success rate of 58%, slightly lower than AO Shearman’s projection. Meanwhile, Troutman Pepper Hamilton Sanders LLP + Pepper Hamilton LLP and Clyde & Co LLP + Berrymans Lace Mawer achieved retention success rates of 51% and 67%, respectively. Dentons + Durham Jones & Pinegar, P.C. reported a retention success rate of 73%, like Dentons + Bingham Greenebaum Doll LLP. Overall, AO Shearman’s projected retention success rate falls within the range observed in other notable law firm mergers, indicating a competitive level of success in retaining talent post-merger.

When it comes to mergers of this scale and the redundancies and culture clashes, they entail, recent history shows a gradual winnowing of personnel is to be expected.

- Projected Growth Decline: The projected decline of 17% over four years implies a slowdown in the combined firm’s growth trajectory compared to the growth rates of the individual firms before the merger. This could be attributed to factors such as integration challenges, market conditions, or strategic shifts post-merger.

- Combined Attorneys: The combined number of attorneys post-merger is 3,304, representing an increase of 484 attorneys compared to the pre-merger total. This growth in attorney headcount suggests an expansion of the firm’s capabilities and resources.

- Common Locations and New Locations: The presence of 17 common locations indicates an overlap between the geographical footprint of Allen & Overy and Shearman & Sterling before the merger. Additionally, adding new locations such as Austin, TX; Dallas, TX; Houston, TX; and Menlo Park, CA, along with one more undisclosed location, suggests a strategic expansion into key markets, possibly to capitalize on new business opportunities or enhance existing client relationships.

Overall, while the projected retention success rate and growth decline indicate some challenges and adjustments associated with the merger, the addition of new locations and the increase in combined attorneys suggest a strategic move toward strengthening the firm’s presence and capabilities in targeted markets.

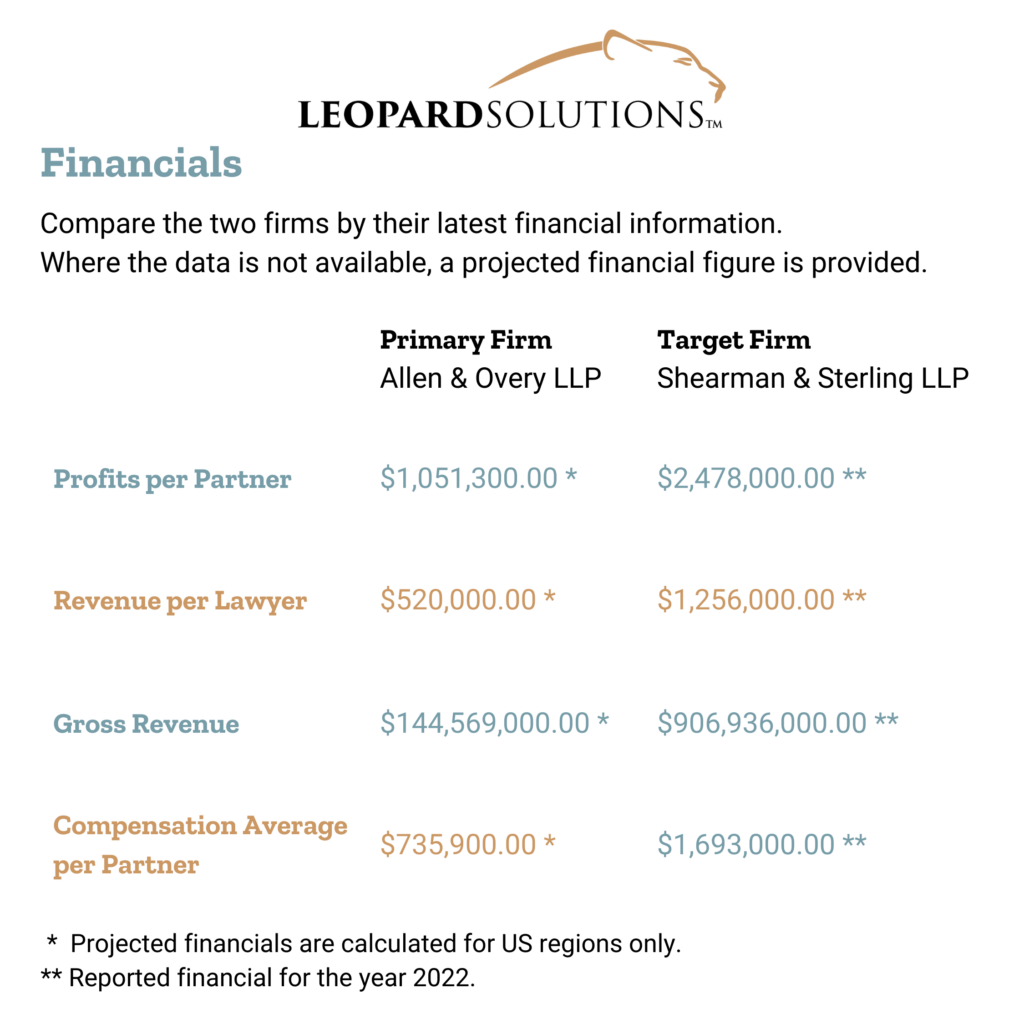

Next, for our comparison, we zoomed out on the financials for both firms:

- Profits per Partner: Shearman & Sterling LLP boasts a significantly higher profit per partner figure of $2,478,000 compared to Allen & Overy LLP’s projected figure of $1,051,300. This suggests that partners at Shearman & Sterling earn more on average, potentially indicating higher profitability or more efficient operations.

- Revenue Per Lawyer: Shearman & Sterling also outperforms Allen & Overy in revenue per lawyer, with a figure of $1,256,000 compared to Allen & Overy’s projected figure of $520,000. This metric reflects the firm’s ability to generate more revenue per attorney, which could indicate higher billing rates, better client relationships, or more lucrative practice areas.

- Gross Revenue: Shearman & Sterling’s reported gross revenue of $906,936,000 dwarfs Allen & Overy’s projected figure of $144,569,000. This substantial difference suggests that Shearman & Sterling operates at a much larger scale in total revenue generation, likely due to a combination of factors such as client base, practice areas, and global reach.

- Compensation Average Per Partner: Like profits per partner, Shearman & Sterling’s reported average compensation per partner of $1,693,000 exceeds Allen & Overy’s projected figure of $735,900. This further underscores the disparity in partner compensation between the two firms, indicating potentially higher rewards for partners at Shearman & Sterling.

Based on these financial metrics, Shearman & Sterling is in a stronger financial position than Allen & Overy, with higher profitability, revenue generation, and partner compensation. This could influence the merger dynamics and the integration process between the two firms.

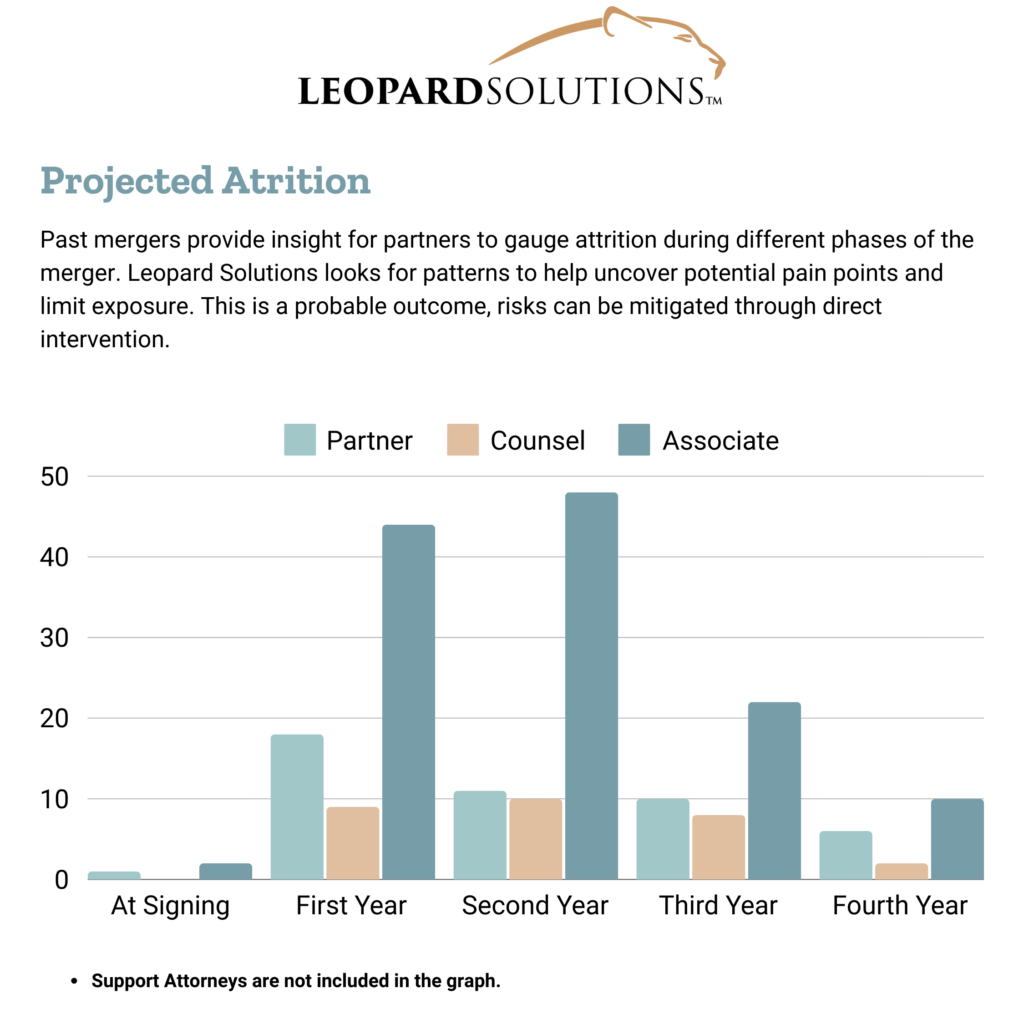

The projected attrition figures provide valuable insights into potential challenges and risks associated with the merger between Allen & Overy and Shearman & Sterling. Here’s an analysis of the projected attrition data across different phases of the merger:

- At Signing: Only one partner is projected to leave the combined firm at the merger’s signing, indicating initial stability among partners during the initial stages of integration.

- First Year: The number of departures significantly increases in the first year after the merger, with 18 partners, nine counsels, and 44 associates leaving the firm. This spike in attrition suggests that the first year could be a period of adjustment and uncertainty for some members of the combined firm, possibly due to integration challenges, cultural differences, or strategic realignment.

- Second Year: Attrition rates remain relatively high in the second year. However, they show a slight decrease compared to the first year. Eleven partners, ten counsels, and 48 associates are projected to leave during this period. While the decline in departures compared to the first year may indicate a stabilization, it still signifies ongoing challenges in retaining talent and fostering cohesion within the merged entity.

- Third and Fourth Year: Attrition rates continue to decline in the third- and fourth years post-merger, with fewer departures among partners, counsel, and associates. However, it’s worth noting that attrition rates remain non-negligible, suggesting that even in the later stages of integration, the merged firm may still experience some turnover.

Overall, the projected attrition data highlights the importance of proactive intervention and strategic planning to mitigate potential pain points and limit exposure during different merger phases. Addressing integration challenges, fostering a cohesive organizational culture, and prioritizing talent retention efforts will be crucial for the long-term success and stability of the combined firm.

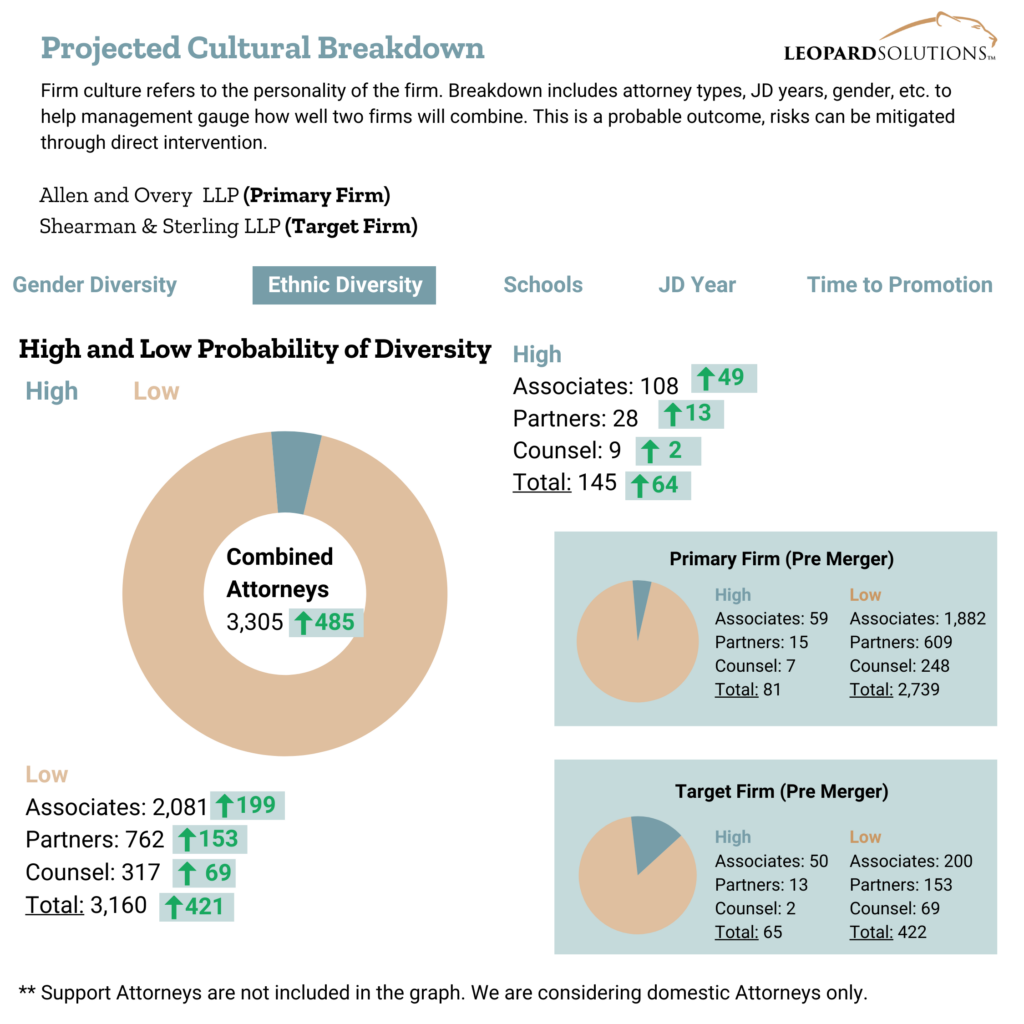

Lastly, the projected cultural breakdown between Allen & Overy LLP and Shearman & Sterling provides insights into the potential composition of the combined firm and its diversity profile.

- High Probability of Diversity:

- Within its cohort of high-probability diverse members, the merged firm anticipates a surge in diversity across all categories of legal professionals, encompassing associates, partners, and counsel alike.

- The total number of diverse attorneys (145) is projected to increase by 64 individuals compared to the pre-merger total.

- This increase reflects a concerted effort to enhance diversity within the combined firm, potentially through recruitment strategies, inclusion initiatives, and cultural integration programs.

- The emphasis on diversity aligns with contemporary trends in the legal industry, where firms recognize the value of fostering a diverse and inclusive workplace culture.

- Low Probability of Diversity:

- Even within the low-probability diverse group, diversity remains modest compared to pre-merger statistics, albeit less substantial in magnitude.

- The total number of diverse attorneys (3160) is projected to increase by 421 individuals, indicating a more modest improvement in diversity than their high-probability counterparts.

- This scenario suggests that the combined firm may face challenges in achieving significant diversity gains, potentially due to existing cultural differences, recruitment limitations, or retention issues.

- While the firm may still prioritize diversity initiatives, the impact may be more limited than the high probability scenario.

It will take several years to accurately assess this merger’s success from a Return on Investment (ROI) perspective. In the meantime, one key indicator to monitor is how it influences the broader market landscape. Will it catalyze more transatlantic partnerships, signaling a trend toward greater globalization in the legal sector? Or will it reinforce the notion that the two sides are incompatible, mainly due to differences in the emphasis on Profit Per Partner (PPP) and the preference for those who generate the highest billables in the US? If the merger encounters difficulties early on, it may bolster this perception. However, if it proves successful, it could pave the way for further consolidation within the market. Only time will tell how this merger will shape the legal industry’s future.